GIPSA stands for the General Insurance Public Sector Association, a group of four public sector general insurance companies. These companies are National Insurance, Oriental Insurance, United India Insurance, and New India Assurance. These insurers have empaneled a number of hospitals across India, referred to as the Preferred Provider Network (PPN). Apart from the PPN package rates for surgical procedures, hospitals also agree to offer discounts on their cash rates (treatment costs for patients without insurance) to policyholders of these insurance companies.

In simple terms, hospitals empaneled with these insurance companies under GIPSA PPN agree to PPN package rates for surgical procedures and offer specific discounted rates for treatments not covered under the PPN package.

GIPSA PPN packages

Suppose a patient undergoes an appendectomy (removal of the appendix) at a PPN hospital. The hospital would normally bill the patient for various services such as room rent, doctor’s visits, nursing charges, medication, surgeon fees, operating theater costs, etc.

For example, the hospital may bill ₹1 lakh for the appendectomy. GIPSA companies negotiate with hospitals for a lump-sum treatment cost for this procedure and others. The hospital may agree to a package rate of ₹50,000 for GIPSA policyholders. Therefore, any person insured by these four companies who gets treated at a GIPSA-empaneled hospital (PPN) would receive the treatment for ₹50,000.

This creates a win-win situation for all three stakeholders: insurance companies, policyholders, and hospitals. Hospitals receive a steady flow of insured patients, policyholders save on treatment costs, thereby utilizing less of their overall coverage limit, and insurance companies reduce their treatment expenses.

Cashless treatment in a PPN hospital

Generally, cashless treatment in a GIPSA PPN hospital is hassle-free. If the policyholder is undergoing a procedure covered by the PPN package, the hospital bills the insurance company directly according to the agreed PPN rate, and the patient is discharged without paying out of pocket.

In cases of non-surgical treatments, also known as medical management cases, hospitals also provide certain discounts on their standard rates (rack rates) to insurance company. The policyholder does not need to worry about these negotiations, as they are handled between the insurance company and the hospital.

Hospitals charging more than the PPN package

In some cases, hospitals may charge extra beyond the PPN package for certain reasons, which you might have to pay out of pocket.

For example, the cost of cataract treatment under PPN packages ranges from ₹25,000 to ₹40,000 and includes the cost of a standard lens. However, if you opt for a specific brand of lens, the hospital may charge more than the PPN package, and you would have to cover the additional cost. This is because the PPN package only covers the standard lens, which typically costs between ₹5,000 and ₹7,000.

Therefore, if you choose a specific brand implant that exceeds the standard rates, you will need to pay the difference out of pocket.

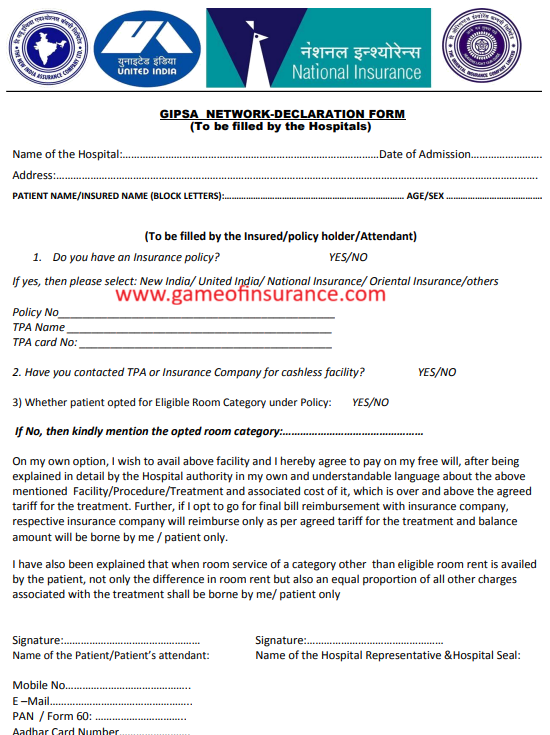

GIPSA Declaration Form

If you are a policyholder of any of these four PSGIC companies and seek treatment at a PPN hospital, the hospital will provide a GIPSA Declaration Form. This form is important, especially if you are not availing of cashless treatment or even plan to claim reimbursement. The claim will be settled according to the agreed PPN rates between the hospital and the insurance company. By signing the form, you agree to have your claim settled as per PPN rates.

Even if you don’t sign the declaration, the chances of your claim being settled based on PPN rates are high if you are using a PPN hospital. If you’re not availing of cashless treatment for a specific reason, you must inform your insurance company. However, to avoid deductions in your claim amount, it’s always better to opt for cashless treatment at a network hospital.

Availability of PPN Hospitals

The PPN hospital network is not available nationwide but is limited to 13 cities only -Indore, Coimbatore, Ahmedabad, Bengaluru, Chandigarh, Chennai, Delhi, Hyderabad, Kolkata, Mumbai, Nagpur, Pune, Jaipur.

This does not mean that cashless treatment is limited to these cities only, as outside of these cities, insurance companies rely on TPA (Third-Party Administrator) network hospitals.

If you have a health insurance policy from any of these insurance companies, your policy will include the name of the TPA that services your policy. You can visit the TPA’s website to check the list of network hospitals in your city.

Tips for Avoiding Claim Deductions

To avoid any hassle and unnecessary deductions in your claim amount, it is wise to choose a network hospital of your insurance company. If you have a policy from National Insurance, Oriental Insurance, United India Insurance, or New India Assurance, it is recommended to opt for a PPN hospital, especially for planned hospitalizations. Always choose cashless treatment at a PPN hospital to avoid paying upfront and later filing for reimbursement, as the hospital may charge you beyond the package rates. In such cases, the TPA or insurance company will settle the claim based on the PPN-agreed rates with the hospital, which are usually lower than the hospital’s billed rates.