Super top up insurance policies can be confusing, especially when it comes to claim settlements. I have simplified the concept using examples to explain how these policies work and whether you should consider buying a super top-up health insurance policy.

What is Deductible in Super Top Up Health Insurance?

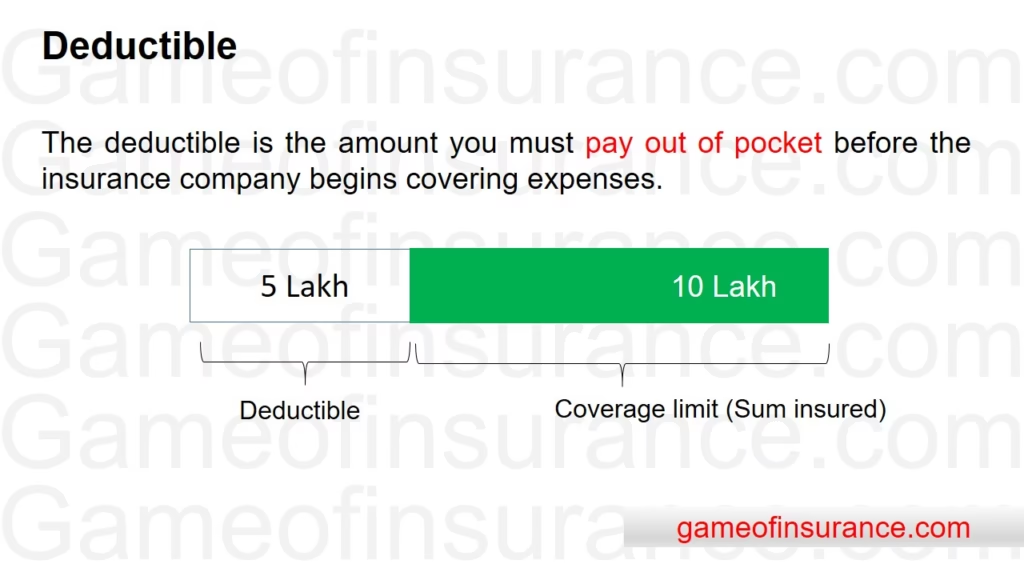

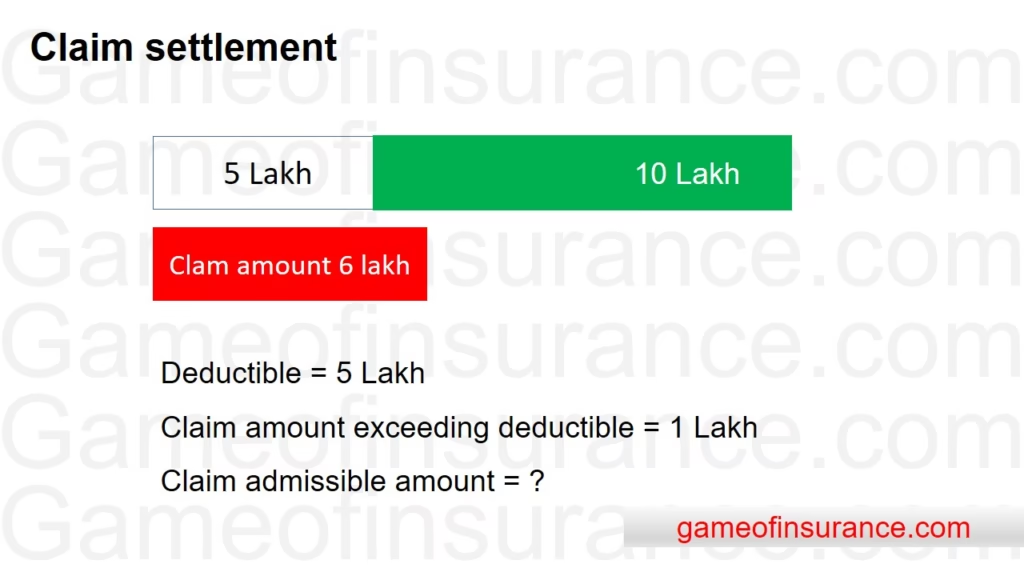

A super top-up policy covers claims exceeding a specified limit, called the deductible. The deductible is the amount you must pay out of pocket before the insurance company begins covering expenses. For example, if your super top-up policy has a deductible of ₹5 lakh and a coverage limit of ₹10 lakh, the policy will cover claims beyond ₹5 lakh. If your total hospitalization bills in a policy year amount to ₹6 lakh, the policy will pay ₹1 lakh, as the first ₹5 lakh is the deductible you are responsible for.

However, insurance companies evaluate claims based on the policy’s terms and conditions. If, out of a ₹6 lakh bill, suppose ₹1 lakh pertains to non-payable items as per the policy, then the admissible amount is reduced to ₹5 lakh. Since this is within the deductible limit, no claim will be paid. This mean even when the bill exceeds the deductible, only admissible expenses are covered under the policy.

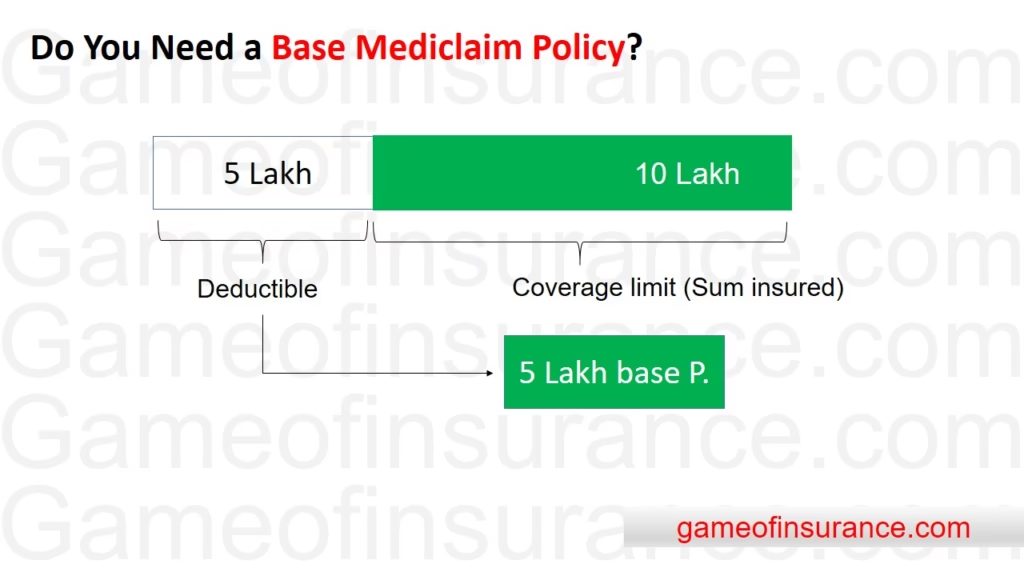

Do You Need a Base Mediclaim Policy to buy Super Top Up Health Insurance ?

Short answer is ‘NO‘. A super top-up policy can be purchased even if you don’t have a base health insurance policy. In this case, you would bear the deductible amount yourself before the super top-up policy kicks in.

If you already have a base mediclaim policy, claims are processed sequentially. For example, if you have a ₹5 lakh base policy and incur a ₹10 lakh hospital bill, the base policy settles the first ₹5 lakh. The hospital bill can then be submitted under the super top-up policy for rest of the amount.

Each policy functions independently, following its respective terms, conditions, and waiting periods.

Super Top-Up Policy: From the Same or a Different Insurance Company?

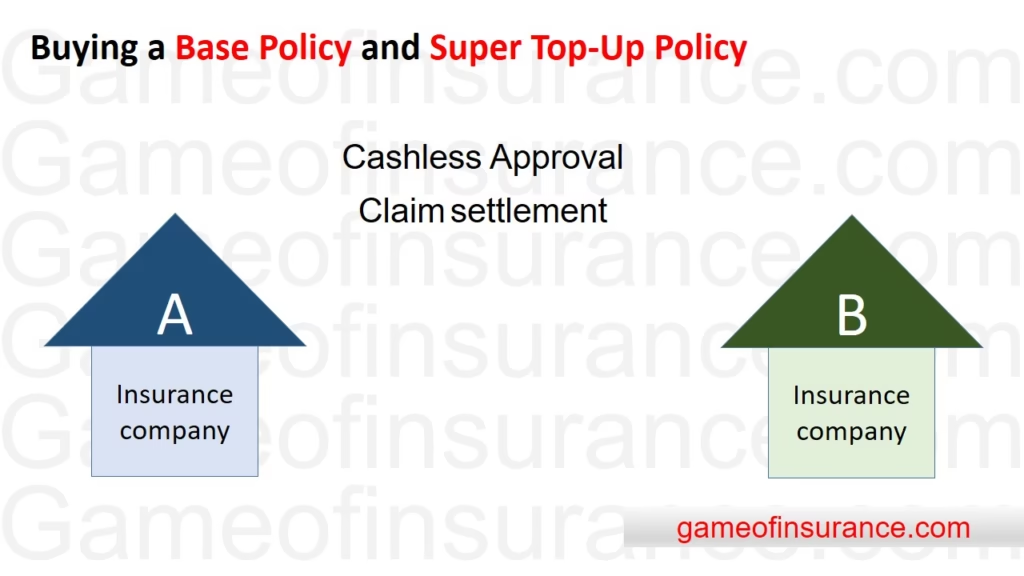

For a seamless cashless experience, it is often convenient to have both the base mediclaim and super top-up policies with the same insurer. This avoids the hassle of submitting claims to multiple companies. However, there is a drawback: the insurer may apply the same assessment criteria for both policies, potentially rejecting claims across the board.

To mitigate this, you can consider holding a base policy from a private insurance company and a super top-up policy from a public sector insurer. Public insurers are often more lenient in claim settlements. For example, a claim denied by a private insurer might still be approved by a public insurer for amounts above the deductible.

Ease of Purchase for Those with Medical History

If you have a chronic condition or adverse medical history, obtaining a standard health insurance policy can be challenging, as insurers often avoid high-risk individuals. However, super top-up policies are typically easier to purchase, as you bear the deductible amount yourself, reducing the insurer’s overall risk exposure.

Waiting Periods Apply

Super top-up policies also come with waiting periods, similar to regular health insurance plans. Coverage for certain conditions begins only after the specified waiting period. Additionally, pre-existing conditions are covered based on terms outlined in the policy, often after the waiting period elapses. In fact, super top up policies are like regular mediclaim policies with deductible limits.

Final Thoughts

Super top-up policies operate independently of base mediclaim policies, each with unique terms and conditions. You should pay attention to the room rent limit in super top-up policies, as it is often tied to the deductible limit.

By understanding how these policies work and carefully selecting the good insurance company, you can make an informed decision and ensure adequate coverage for significant medical expenses.