If you have tried to buy health insurance you might have come across terms like “Restoration of sum insured” or seen ads promoting 2x or 3x, cover etc. But what do these terms really mean? In this article, I have discussed in detail:

- What “Restoration of sum insured” means in health insurance.

- Key terms and conditions to look for in your policy to ensure this feature is truly beneficial and not just a marketing trick.

- Whether it is better to opt for a policy with a higher sum insured, or one with a lower sum insured but offering multiple or unlimited restorations.

I will try to explain this term with a practical example. Suppose Rohit, who has a health insurance policy with a cover limit of 5 lakh. Unfortunately, Rohit is diagnosed with fatty liver disease and uses up his entire coverage limit during his hospitalization at Apollo Hospital, Delhi from December 1, 2024, to December 10, 2024. However, his policy includes a restoration benefit, which reinstates/restores the 5 lakh sum insured (cover limit) for future use in case of another hospitalization, though this comes with certain conditions.

What are the conditions of using restored sum insured?

However, conditions of using this restored sum insured varies from policy to policy, but few limitations are common across the health insurance policies.

- The restored sum insured cannot be used for the hospitalization event that depleted the sum insured; in fact, this event triggers the activation of this term and the restoration of the depleted sum insured in your policy. In the above example, Rohit cannot use the restored sum insured for his hospitalization at Apollo Hospital, Delhi from December 1, 2024, to December 10, 2024.

- If you do not use the restored sum insured during the policy period, you cannot carry this sum forward to the next policy. This means any unutilized restored sum insured expires with the policy.

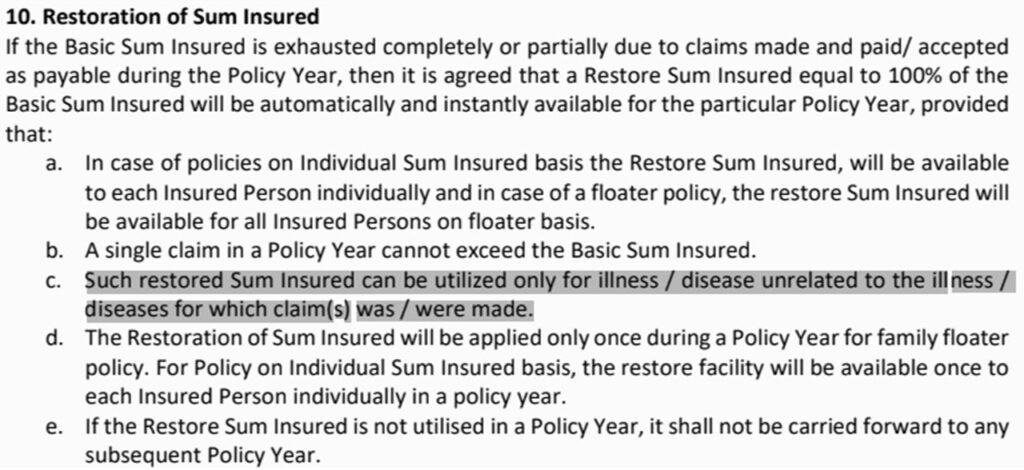

Besides these conditions, the key thing to check in this clause is whether the restored sum insured can be used for all claims or if there are any limitations specific to certain claims. For example Family Medicare policy by United india insurance specifically mentions – “Such restored Sum Insured can be utilized only for illness / disease unrelated to the illness / diseases for which claim(s) was / were made.”

This condition significantly restricts how the restored insurance amount can be used. For example Rohit can’t use this restored amount for liver-related issues. So, it’s important to check this term before buying a policy. Don’t be misled by insurance companies that promote the unlimited restoration benefit without clarifying that it might not apply to all claims.

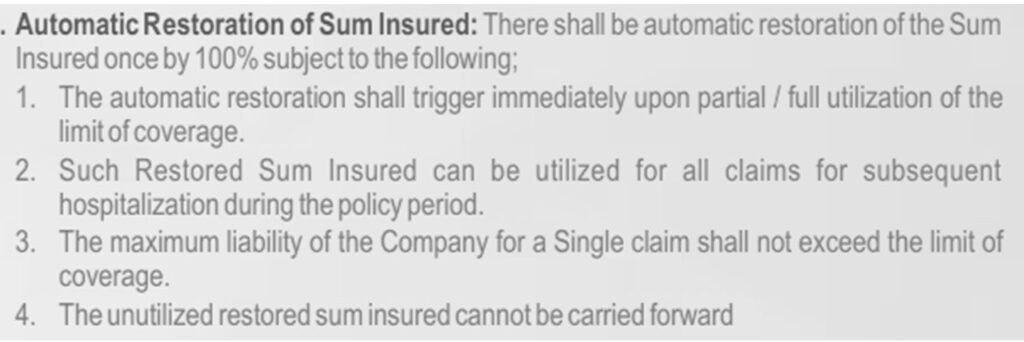

Star health Premier insurance policy provides broader coverage by allowing the use of restored sum insured for all claims except for hospitalisation event that led to activation of this term.

Another limitation on the restored sum insured (cover limit) is that most health insurance policies restrict its use for modern treatment methods. However, the regulatory authority IRDA has approved 12 modern treatments/procedures that health insurances can cover. Insurance companies provides coverage for these 12 treatments, but only up to a certain limit of base sum insured (basic cover limit without any bonus).

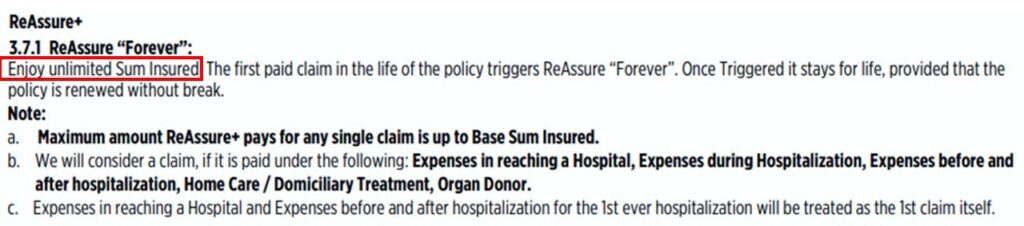

Insurance policy usually mentions how many times sum insured, can be restored during the policy period. If the policy does not mention a specific number, it typically allows for one restoration per policy period by default. However, some policies, like the Niva Bupa ReAssure 2.0, claim to provide unlimited restorations of the sum insured. How is this possible? I have discussed this later in the post.

Most health insurance policies offer restoration benefit only after the total insured amount (and any bonus amount) is used up. However, some policies also restore the base insured amount even if only part of it is used.

Why get a higher sum insured policy if mine includes a restoration benefit?

You might be wondering why you should buy a policy with a higher cover limit !

The answer to this lies in a condition that is part of every restoration benefit clause in every health insurance policy.

“A single claim in a policy year can not exceed the basic sum insured”

In the example above, Rohit has a health insurance policy with a cover limit of 5 lakhs. Although his policy features may have unlimited restoration benefits, which can be used for any claim without restrictions, he can still only utilise a maximum of 5 lakhs per claim, up to the base sum insured.

Considering high medical cost and rise in lifestyle diseases, a single hospitalisation event can easily cost between 20 to 25 lakh in big cities. Therefore, having a health insurance policy with decent basic sum insured is must regardless of other benefits in the policy.

Even unlimited restoration benefit should not be considered an alternative to good base cover limit.

Some health insurance policies provide the restoration benefit but with different names like – reinstatement of sum insured, ReAssure benefit (Niva Bupa) etc.