Latest Articles

The Health Koti Suraksha policy by HDFC Ergo is a health insurance plan that offers both health insurance and comprehensive personal accident coverage. This policy is particularly suitable for those...

HDFC Ergo has announced the launch of cashless post-hospitalization claims, set to roll out in the third week of December 2024 through its app, Here. As the name suggests, post-hospitalization...

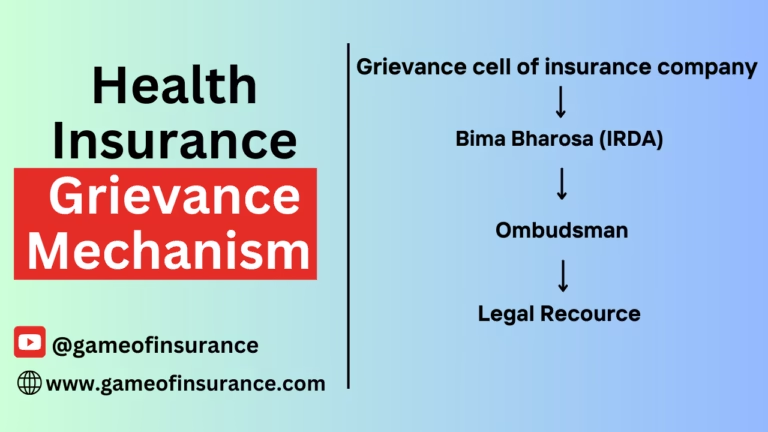

You may have been diligently paying your health insurance premiums for years, feeling secure that your financial worries in case of an illness are covered. But one day, you fall sick, require...

A pacemaker battery generally lasts 5–6 years, but sometimes it might need replacement earlier. Now, the big question: does health insurance cover this cost? Let me explain in simple terms, so there’s...

When purchasing a health insurance policy, the first preference is often to look for plans that have no restrictions or limits in coverage. But is it truly possible to buy a health insurance policy...

The health insurance sector in India is witnessing rapid growth, especially post-COVID, due to heightened awareness among the general populace and double-digit medical inflation. This expanding market...

HDFC Ergo’s flagship health insurance product, HDFC Optima Secure, is one of the most popular and best-selling policies in India. In this post, we’ll review key features of this policy, discuss...

Oriental Insurance, a public sector general insurance company, offers a cancer-specific health insurance policy named Oriental Cancer Protect Policy. This post reviews the key features and limitations...

MD India is a Third Party Administrator (TPA) that settles health insurance claims on behalf of insurance companies. Private insurance companies, however, typically have their own in-house claim...

Insurance News

No posts found.

Coverage Clarity

A Closer Look at India’s Health Insurance Sector: Insights from IRDAI’s Annual Report for FY 2023-24

The Insurance Regulatory and Development Authority of India (IRDAI) has published its annual report for the financial year 2023-24, offering a comprehensive analysis of insurance sector in India. The...

The Insurance Regulatory and Development Authority of India (IRDAI) has been a harbinger of change in the country’s insurance landscape through its timely circulars and guidelines across various...

On January 30, 2025, the Insurance Regulatory and Development Authority of India (IRDAI) issued a new circular senior citizens premium in health insurance policies. The key takeaway? Insurance...

In this article, I’ve compared two of the most popular health insurance policies from Star Health Insurance—SuperStar and Assure Health Insurance. SuperStar is a newly launched policy available...

CT-guided angiography is typically classified as an diagnostic procedure which can be carried out on OPD basis. If your health insurance policy includes coverage for OPD expenses, it may be covered...

Super top up insurance policies can be confusing, especially when it comes to claim settlements. I have simplified the concept using examples to explain how these policies work and whether you should...

Policy Comparison

No posts found.

Section Title

Energy Policy by HDFC ERGO is a health insurance special plan for individuals already living with chronic lifestyle conditions such as Type 1 Diabetes, Type 2 Diabetes Mellitus, Impaired Fasting...

Star Health Diabetic Safe insurance policy is for the people who are already diabetic or dibetic with complication and finding difficulty health Insurance policy. This policy comes with two plans Plan...

There is growing concern among policyholders as well as prospective buyers regarding the “material change” clauses found in certain health insurance policies. The exact wording of this clause in SBI...

IRDAI has released the Flash Figures – Gross Direct Premium Underwritten for and up to October 2025 for non-life insurers. The data shows the market share performance of the top General Insurance and...

If your health insurance policy has a hospital room rent limit, it most likely includes a Proportionate Deduction clause. Let’s understand what this clause means and how it impacts your insurance...

Health insurance policies are no longer a one-size-fits-all product. “Ultimate Care” by Care Health Insurance Limited is one such example. It offers base features and a buffet of 49...

Health insurance is one of those things we all hope we never have to use, but when we do, it better work the way we expect. Unfortunately, that’s not always the case. Many policies look great on paper...

Enhanced External Counterpulsation, or EECP, is a non-invasive treatment that’s gaining popularity among cardiologists, especially for patients with chronic or refractory angina and certain types of...

Healthcare is a major expense for senior citizens in India, especially as life expectancy increases and medical inflation outpaces general inflation. The challenge becomes more pressing after...