On December 28, 2023, the insurance regulator IRDAI granted a health insurance license to Narayana Health Insurance Limited. This makes Narayana Health Insurance the sixth company to operate in the standalone health insurance segment. However, Narayana Health Insurance stands out from the rest because it is the first health insurance company that can leverage its extensive hospital network. Unlike other insurance companies that need to develop a cashless network to serve policyholders, Narayana Health Insurance already has this advantage. On July 30, 2024 Narayana Health Insurance launched its first affordable health insurance plan ‘ADITI’. in this article we will review this plan in detail.

Narayana Health Insurance is promoting ADITI as an affordable healthcare plan with extensive coverage. The plan’s standout features, which are heavily advertised, include:

- Wide coverage at a very low premium

- No waiting period*

- Coverage of consumables

- Seamless and hassle-free cashless settlement

- Free annual checkups

Coverage limited to Nayana Health Network

The standout feature of this policy is its transparency in detailing what is covered and what is excluded. Coverage under this plan is primarily limited to the Narayana Health network, with a few exceptions. Below is the exact wording from the policy documents.

The coverage outside Narayana Health network is severely limited for this plan. It can ONLY be availed in the few scenarios, otherwise it is NOT COVERED.

Narayana Health insurance

There are four exceptions where treatment in hospitals outside the Narayana Health network is permitted. These include emergency situations, treatments not available at Narayana hospitals, and cases related to location changes due to travel or relocation.

Policy communicates clearly that this policy is unlike other health insurance policies, where insurance companies often boast about vast cashless networks of thousands of hospitals. At this stage, the plan is more of a pilot scheme, limited to 21 Narayana hospitals across various states in India. Narayana Insurance is strategically leveraging this network to focus on early disease detection, proactive management, and controlling treatment costs.

Geographical Restrictions of Narayana Health Insurance

The policy has been launched as a pilot project, currently limited to five districts in Karnataka where eight Narayana hospitals are located. The ADITI plan is available for purchase in Mysore, Chamraj Nagar, Kodagu, Mandya, and Hassan. Residents of these districts can purchase the ADITI policy by providing proof of their current address.

Due to the geographical and network restrictions, this plan is primarily attractive to ONLY those living in these cities, especially those residing near one or more Narayana hospitals. However, Narayana Health plans to expand this offering to other cities in the future, depending on the outcomes of this pilot scheme, and a potential increase in premium may accompany such an expansion.

Seamless cashless admission and claim settlement

The policy also claims to offer seamless cashless admission and claim settlement, and there is some truth to this.

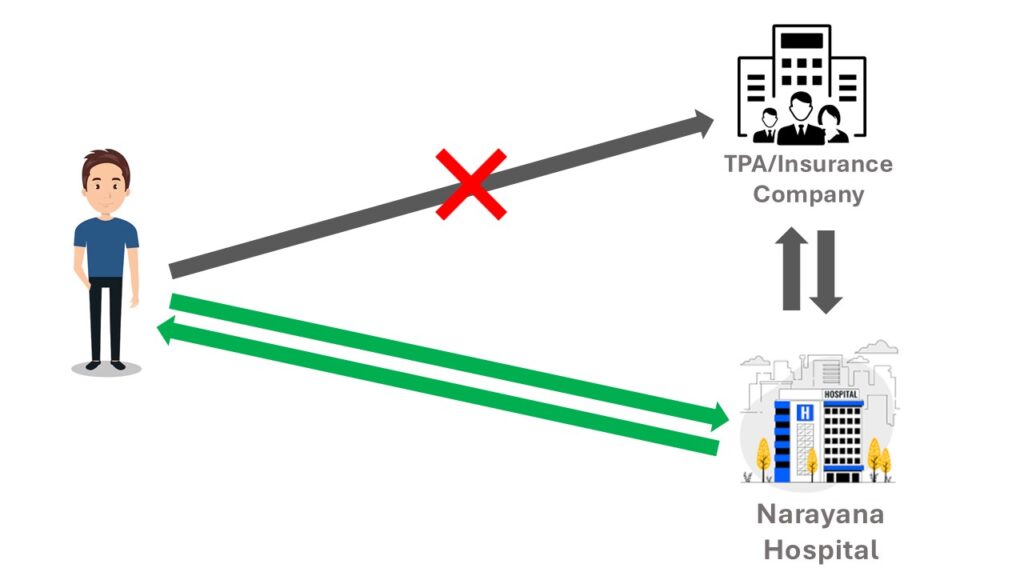

Typically, with a health insurance policy, you would need to coordinate between the insurance company or TPA (third-party administrator) and the hospital during a cashless claim. However, with the Narayana Health Insurance ADITI policy, you only need to interact with Narayana Hospital. The flow of information and documents between Narayana Hospital and Narayana Health Insurance is seamless, requiring no involvement from your side. Simply notify the hospital of your claim, and the Narayana Hospital team will handle the rest. In this way, the cashless claim process is indeed hassle-free and seamless, just as Narayana Health claims.

Coverage under Narayana Health Insurance

Now, let’s address the main point: the coverage limit or sum insured under this policy. While the policy is advertised as offering 1 crore in health insurance for around 10,000 INR, this 1 crore coverage is not available for all types of hospitalizations.

The policy offers coverage of up to 1 crore for surgeries or surgical procedures and 5 lakhs for non-surgical cases. It’s important to clarify that the 5 lakh coverage applies to all non-surgical procedures or admissions for medical management, such as treatment for dengue, COVID, etc., during the policy period. This shouldn’t be mistaken as a 5 lakh limit per event; the total coverage for all non-surgical or medical management hospitalizations is capped at 5 lakhs. The policy has variable sum insured options depending on the type of hospitalization—1 crore for surgical cases and 5 lakhs for non-surgical ones. Additionally, the policy clearly defines what constitutes a surgical procedure and a non-surgical procedure.

General ward room rent

Narayana Health Insurance ADITI policy restricts coverage to the general ward only. The policy sends an important message to the health insurance industry: health insurance should focus on necessity, not luxury. Limiting coverage to the general ward as the room rent cap also makes the plan more affordable since associated expenses, such as consultant fees, surgeon charges, and oxygen costs etc., are typically tied to the room category.

Policyholders can opt for a higher room category, like a private AC room or suite, but they will need to pay the additional pro-rata charges for all associated expenses linked to that room category.

Coverage of cost of consumables

The Narayana Health Insurance ADITI policy covers expenses for consumables. Consumables, such as needles, syringes, gloves, and masks, are medical items used only once and typically account for 10-15% of the hospital bill.

However, not all consumables are covered. The list of covered items is detailed in Annexure 1 of the policy. Additionally, the cost of consumables is not covered in cases of robotic treatments.

Waiting period in policy

The policy claims to offer immediate coverage without any waiting period, but the reality is more nuanced than a simple no-waiting-period claim.

Typically, health insurance policies have three types of waiting periods:

- 30 Days Waiting Period: For illness or disease-related hospitalizations in the first policy year.

- Specific Waiting Period: Ranging from 12 to 24 months for certain diseases or conditions like cataract, fistula, and hernia, as listed in the policy document.

- Pre-existing Conditions Waiting Period: Ranging from 12 to 36 months for pre-existing diseases or conditions.

The Narayana Health Insurance policy does not have the first 30-day waiting period and does not list specific diseases in the policy document. However, waiting periods still apply.

A mandatory medical test is required before purchasing the policy, and the results of this test determine the waiting periods. If the test shows you are healthy with no declared or identified conditions, the policy may have no waiting period.

However, if you declare a medical condition or the test reveals one, the waiting period for coverage may range from 0 to 3 years.

The medical test plays a crucial role in determining the waiting period and even eligibility for the policy. The benefit is that once you qualify for the policy after the medical test, you also protected from claim denial due to obscure terms like “non-disclosure of material facts”.

Deductions in policy

The ADITI Policy offers two plans. In Plan 1, a deduction of 2,000 INR is applied per day of hospitalization for all types of claims. For instance, if a policyholder is hospitalized for 5 days, the claim amount will be reduced by 10,000 INR. In Plan 2, the 2,000 INR deduction per day of hospitalization applies only to non-surgical claims.

However policy has ZERO copay but policy apply10% co-pay in specific cases. This applies if the policyholder receives treatment at a non-network hospital and does not notify the insurance company within 24 hours in an emergency or fails to inform them 48 hours before relocating or traveling to a new city.

gameofinsurance rating of Narayana Health Insurance

The Narayana Health Insurance ADITI policy is an innovative pilot product, launched with much fanfare by an insurance company that has recently obtained its health insurance license and specializes primarily in operating hospitals.

However, there are some concerns regarding the company’s experience in running a health insurance business. This product is currently a pilot initiative, limited to a small geographic area and a restricted network. In an era where the IRDAI is pushing for 100% cashless coverage across all hospitals nationwide, this product seems to be moving against the regulatory trend.

The real test will come when the policy is rolled out on a national scale and its restrictions to the Narayana Health network are lifted. The premium, which appears affordable now, may not remain so after removals of restrictions and expansion.

Additionally, the coverage of 5 lakh for non-surgical cases is currently low and may need revision.

That said, it’s worth noting that the policy terms are clear and straightforward, unlike many other health insurance policies that are complicated by jargon. There’s no lengthy list of diseases to decipher regarding the waiting period.

With a premium of 13,000 to 15,000 INR for a family of four, the policy appears quite affordable at this stage. If you’ve undergone the mandatory medical test, live near a Narayana hospital, and Narayana is offering you this policy, it’s a good idea to consider it without hesitation.