On January 30, 2025, the Insurance Regulatory and Development Authority of India (IRDAI) issued a new circular senior citizens premium in health insurance policies. The key takeaway? Insurance companies cannot increase premiums for senior citizens by more than 10% per year. If they want to hike it beyond this limit, they must first get approval from IRDAI.

Why is this important? Because in recent years, senior citizen health insurance premiums have skyrocketed—especially after COVID-19. Even before the pandemic, health insurance for older people was always expensive. The reason is simple: as people age, the likelihood of illnesses and hospitalizations increases, leading insurance companies to charge higher premiums to cover the potential claims.

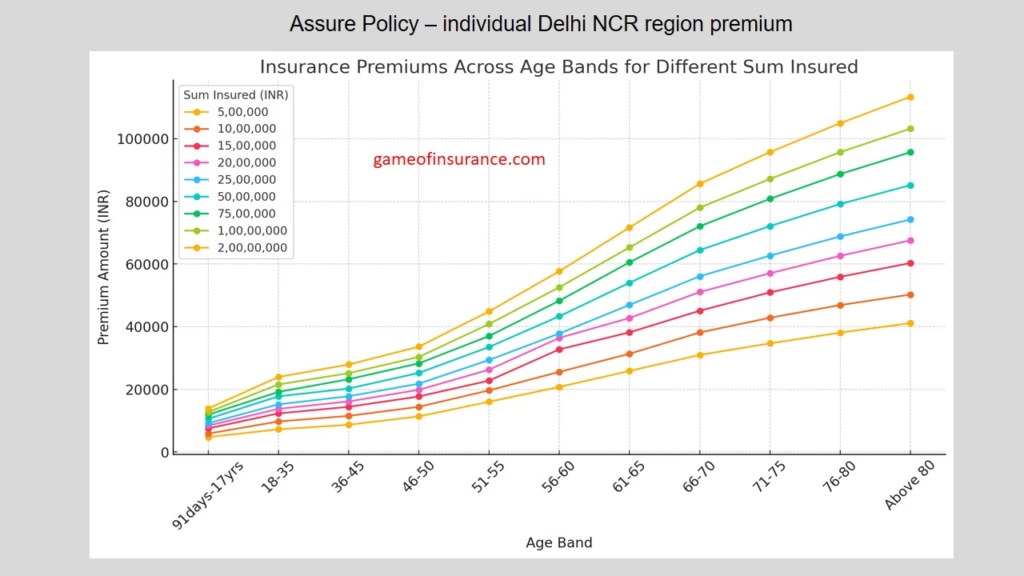

If you look at the premium trends for senior citizens in different policies, like in Star Health Assure Insurance Policy and , you will notice that premiums rise sharply after the 51-55 age group. This trend is not unique to one insurer—it applies to almost all health insurance plans in India.

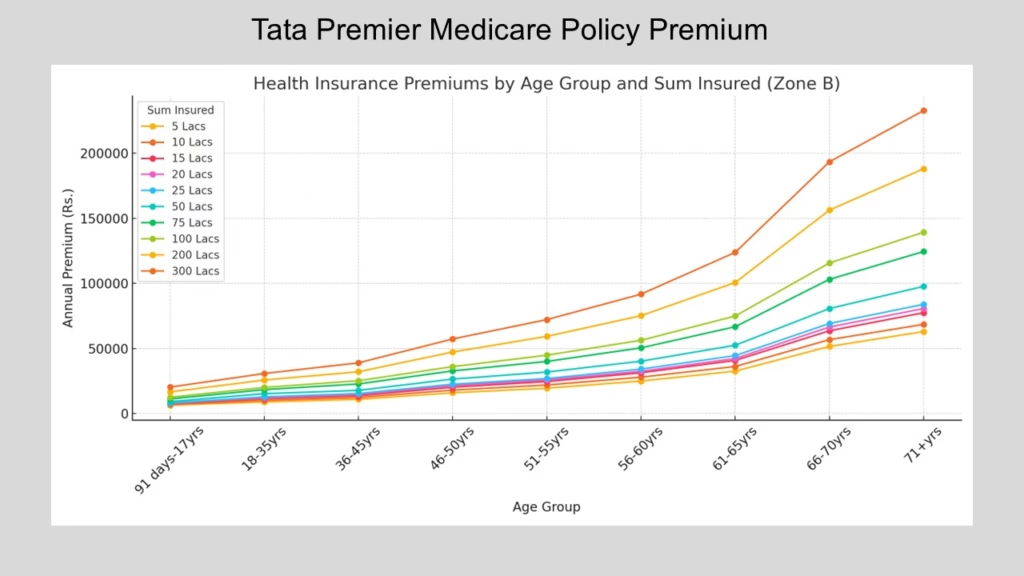

A similar trend can be seen in the Tata Premier Medicare policy, where premium increases are gradual across age slabs until 61-65. Beyond this, the hike becomes significantly steeper.

IRDAI’s 10% Cap – A Relief or a New Problem?

From a policyholder’s perspective, IRDAI’s decision to cap the annual premium hike at 10% is a welcome move. It ensures affordability and continuity of health insurance cover. This will also help to bring more senior citizens under health insurance cover. However, these guidelines comes with its own set of challenges.

Insurance companies are businesses that operate for profit. If they cannot freely raise premiums for senior citizens, they will find other ways to manage their financial risks. Here’s what might happen next:

- Stricter Policy Approval for Older Individuals: Insurers may become more selective about whom they provide coverage to. People with pre-existing conditions or adverse medical histories might find it much harder to get a policy.

- Increased Focus on Younger Customers: Since older policyholders are now less profitable, insurers may aggressively market their policies to younger individuals, encouraging them to buy policies early when they are considered low-risk.

- Discontinuation of Existing Policies: If a policy becomes unprofitable, insurers may choose to discontinue it altogether. This is allowed under IRDAI rules because while the regulator has capped premium hikes, it does not prevent insurers from withdrawing products. Companies only need to follow the required procedures to notify customers before discontinuing a policy.

- Higher Premiums for Young Policyholders: To balance the revenue loss from senior citizen policies, insurers may increase premiums for younger individuals. This will create an indirect form of cross-subsidization, where younger policyholders end up subsidizing the cost of senior citizens’ policies.

- More Disease-Specific Caps: Insurers may introduce capping on age-related treatments like knee replacements, cataract surgeries, and other common old-age procedures. This means that even if you have a health insurance policy, you might still have to pay a significant portion of medical expenses out-of-pocket.

Overregulation Can Stifle Innovation

While IRDAI’s move seems beneficial to policyholders in the short term, overregulation can sometimes backfire. If the insurance sector does not remain profitable, companies will reduce their focus on innovation. This could lead to fewer new products tailored for senior citizens and a market dominated by outdated, restrictive policies.

This situation is similar to what happened in the pharmaceutical industry, where government-imposed price caps on essential medicines led to reduced foreign investment in the sector. Given that India recently opened its insurance sector to 100% FDI, this cap on premium hikes seems contradictory to broader economic goals.

Final Thoughts

While IRDAI’s decision is aimed at protecting senior citizens from steep premium hikes, its long-term impact remains uncertain. In the coming years, we will see whether this move truly benefits policyholders or if it forces insurance companies to adopt strategies that make health insurance even harder to access for older individuals.