HDFC Ergo’s flagship health insurance product, HDFC Optima Secure, is one of the most popular and best-selling policies in India. In this post, we’ll review key features of this policy, discuss potential areas of concern, and give a final verdict on whether it’s worth considering for your health insurance needs.

Basic Features of HDFC Optima Secure Policy

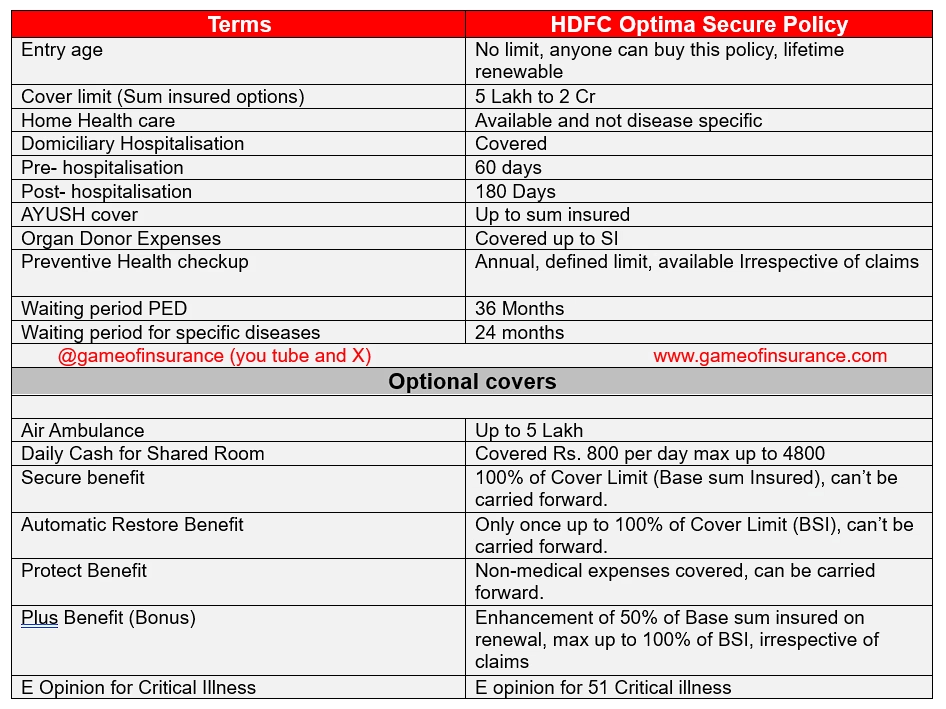

Before reviewing the policy conditions in details lets check the basic feature of this policy.

Policy features worth highlighting

1.Home Healthcare Benefit – Optima Secure offers cashless home healthcare for illnesses that usually require hospital admission. After COVID, many health insurance policies have started including this feature, but what sets Optima Secure apart is that there’s no restriction based on specific diseases. However you need to take prior approval from HDFC just like cashless pre-authorization request for Hospitalisation. Home health care is different from domiciliary hospitalisation, however policy also covers domiciliary hospitalisation

2. Extended Pre and Post-Hospitalization Coverage – This policy provides a wide coverage window: 60 days before hospitalization and 180 days after. Why does this matter? In cases of major surgeries or chronic diseases like heart surgery or cancer, recovery can be lengthy and expensive. Continuous follow-up visits, medications, and treatments add up quickly. The extended coverage ensures you’re protected from these additional expenses.

3. 50% Renewal Bonus Regardless of Claims (Plus Benefit) – A big plus here is the 50% bonus on your base sum insured every year, even if you’ve made a claim. So, if you claimed during the year, you still get this bonus on renewal. By your second renewal, your base sum insured could double! This feature stands out because, unlike most policies that offer a bonus only when you have a claim-free year, Optima Secure gives it to you regardless.

4. Secure Benefit – Double Coverage from Day One : This is the USP of the policy: it doubles your coverage right from the start. If you choose a ₹10 lakh cover, you actually get ₹20 lakh coverage from day one. But here’s the catch—are you really getting a competitive premium, or is it just a marketing gimmick where you’re paying for a ₹20 lakh policy? We’ll break this down later with some examples to see if it’s worth it.

5. Automatic Restore of Sum Insured – Optima Secure also restores your base sum insured automatically once it’s fully or partially used up in claims. This benefit is available once a year and can be used for any future claims, even if it’s for the same illness as before. Many other policies limit this to new illnesses, so this flexibility is a great advantage.

6. Up to 4x Coverage at Competitive Premiums – One of the strongest features of this policy is the potential for coverage up to 4 times the base sum insured (due to secure benefit, Plus benefit, and Restore benefit), without a sky-high premium. For example, if you buy a ₹20 lakh policy, your effective coverage could be much higher due to the added benefits. This isn’t just a standard ₹20 lakh limit like traditional policies; the total coverage can be much more, giving you better value for your premium.

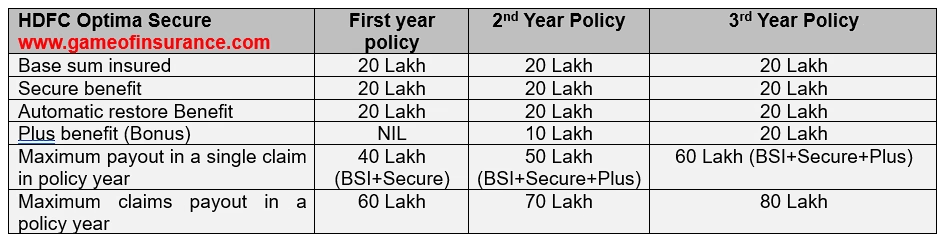

From the illustration above, it’s clear how the 4X coverage works in the Optima Secure policy. Let’s say you have a policy with a cover limit of ₹20 lakhs. By the 3rd year, your total coverage could reach up to ₹60 lakhs for a single event of hospitalisation, broken down as follows:

- ₹20 lakh from the Secure Benefit (doubles your base cover right from day one)

- ₹20 lakh from the Plus Benefit (additional bonus over the years)

- ₹20 lakh from the Restore Benefit (replenishes your sum insured once it’s used up)

However, it is important to note that Restore Benefit cannot be used for the same hospitalization event that initially triggered it. Instead, it can only be applied to subsequent hospitalizations. So, in a single hospitalization event, HDFC’s maximum liability would be up to ₹60 lakhs, even if your base policy is just ₹20 lakhs and In a policy period HDFC Optima policy can pay up to ₹80lakhs claims. This setup provides excellent coverage and peace of mind, even if the premium is slightly higher.

When we compare the premium of HDFC Optima Secure with similar policies from other insurers, we notice that HDFC charges almost double the premium for a ₹10 lakh sum insured policy. Although HDFC offers a minimum 2x coverage from day one, this higher premium reflects that extra coverage. In other words, the 2x coverage benefit is already factored into the cost.

| Age of person | HDFC Optima Secure (10L Policy) | Star Health Assure (20L Policy) | ICICI elevate (20L Policy) | Tata AIG Medicare Premier (20L Policy) |

|---|---|---|---|---|

| 36 years | 16100 | 16150 | 12931 | 16530 |

| 46 Years | 21100 | 19860 | 20476 | 24000 |

| 56 Years | 37100 | 34468 | 33753 | 38248 |

However, even with this higher premium, other features like the Plus Benefit and Restore Benefit offer significant value. These enhancements increase your overall coverage without the usual restrictions seen in other health insurance policies. For instance, many insurers cancel bonuses if a claim is made, but HDFC continues to offer these benefits regardless, making the policy a strong contender despite the premium difference.

7. Protect Benefit feature in the HDFC Optima Secure policy covers non-medical expenses that are usually excluded from standard health insurance policies. Given that 10-15% of medical bills often consist of these non-payable items, this coverage is crucial as it helps reduce out-of-pocket expenses for the policyholder during claims.

8. E-Opinion for Critical Illnesses – Need a second opinion? The policy offers e-opinion for 51 critical illnesses from its network hospitals. This ensures you have expert advice when facing serious health conditions, giving you confidence in your treatment plan.

9. Protection Against Claim Rejection for Pre-Existing Diseases – Claim rejections for undisclosed pre-existing diseases are common in health insurance. Often, policyholders aren’t even aware of these conditions or diseases until diagnosed later. Most insurers use this as a reason to reject claims, blaming the customer for non-disclosure. Optima Secure handles this differently. If a pre-existing condition is discovered later, the policy may either:

- Exclude it permanently.

- Increase the premium at renewal.

- Impose a waiting period of up to 3 years.

But your policy won’t be canceled or discontinued because of this, unlike with many insurers. It’s a customer-friendly move by HDFC Ergo, focusing on keeping your coverage intact rather than finding reasons to void it.

10. Clear and Transparent Policy Terms – Optima Secure spells everything out clearly—no hidden surprises. It mentions upfront when loading (extra premium) might be applied, ranging from 100% to 150% depending on various factors at the time of purchase or renewal. This transparency means you know what to expect, avoiding nasty surprises later.

Caveats and Considerations– Optima Secure

Policyholders have claimed that HDFC Optima Secure offers coverage for 12 modern treatments up to the full sum insured but this isn’t clearly mentioned in the policy document. Including this term clearly in the policy wordings would help avoid confusion and provide more transparency for policyholders.

The policy has a standard waiting period of 36 months for pre-existing diseases (PED) and 24 months for specific illnesses/surgeries/treatments. Competing flagship products from other insurers offer shorter waiting periods and even provide an option to reduce this waiting period by paying an additional premium. If Optima Secure had included a similar feature, it would have been a stronger offering.

The policy does not include a 90-day waiting period for lifestyle-related conditions like hypertension, diabetes, and cardiac issues, which is a standard requirement as per IRDAI’s Master Circular on Standardization of Health Insurance Products (Ref: IRDAI/HLT/REG/CIR/193/07/2020, dated 22nd July 2020). Including this would align the policy with regulatory guidelines and provide better initial coverage for these common conditions. Policy is silent on this this waiting period for lifestyle-related conditions.

Hdfc Ergo Optima Secure Premium Chart

The policy has a two-zone premium structure: Zone 1 covers Delhi NCR, certain cities in Maharashtra and Gujarat, while Zone 2 includes the rest of India. Premiums for Zone 2 are lower compared to Zone 1, mainly due to factors like higher treatment costs and higher claim payouts in Zone 1 cities. However, even if you reside in Zone 2 and buy the policy at Zone 2 rates, you won’t face any co-pay or deductions if you receive treatment in a Zone 1 city. This means the claim amount remains unaffected, no matter which zone you receive treatment in.

You can check the complete premium chart of this policy here

Final Verdict: Is HDFC Optima Secure a Good Buy?

HDFC Optima Secure stands out with its promise of extended coverage right from day one, offering up to 4x the base sum insured over time. Its Secure Benefit, Plus Benefit, and Restore Benefit are well-designed features that enhance overall coverage limit without restrictive conditions. Unlike many competitors, this policy provides consistent bonus increments even after claims, making it attractive for those looking to maximize their coverage without worrying about claim-free renewals.

However, the higher premium can be a point of concern. When compared to similar policies from other insurers, the cost of a ₹10 lakh Optima Secure plan is nearly equivalent to a ₹20 lakh plan from others. This indicates that the 2x coverage from day one is already factored into the premium.

Overall, despite these concerns, Optima Secure’s approach of offering broader coverage with fewer disease-specific restrictions, backed by HDFC Ergo’s strong brand reputation and reliable claims service, makes it a solid option. For those seeking extensive coverage and willing to pay a slightly higher premium, the policy can provide significant value. Even a ₹10 lakh plan could offer up to ₹30 lakh coverage for a single claim in the third policy year and a total claim payout of up to ₹40 lakh annually, making it a compelling choice for comprehensive health insurance.

In conclusion, if you’re looking for a health insurance plan with high coverage, minimal sub-limits, and customer-friendly features, HDFC Optima Secure is definitely worth considering.