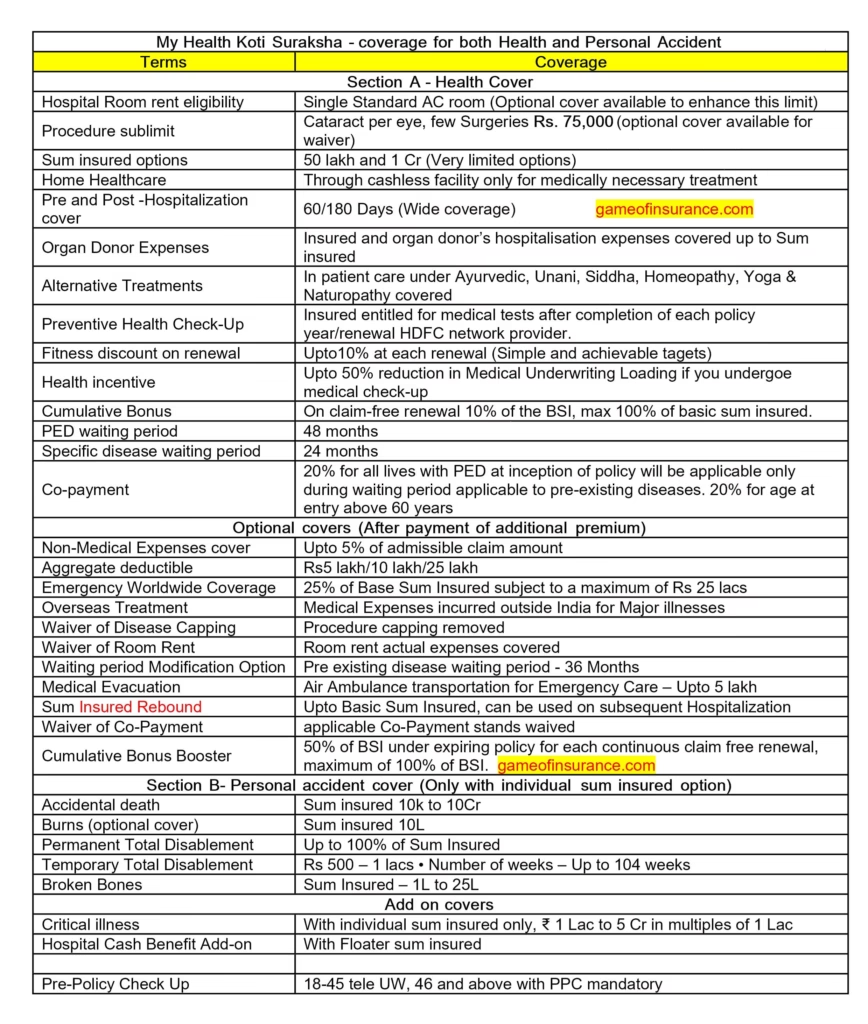

The Health Koti Suraksha policy by HDFC Ergo is a health insurance plan that offers both health insurance and comprehensive personal accident coverage. This policy is particularly suitable for those seeking to combine health insurance and personal accident coverage into one plan, allowing customization based on individual needs.

The policy includes various features and optional covers that you can choose according to your requirements. However, personal accident cover is available only with individual sum insured, not as a floater option and Hospital Cash Benefit is the only add-on available with the floater sum insured option.

Standout feature of Health Koti Suraksha Policy

Policy Offers 60 days pre-hospitalization and 180 days post-hospitalization coverage, which is significantly more generous than typical policies (30 days pre and 60 days post). This is especially beneficial for managing chronic diseases where post-hospitalization expenses related to consultations and medicines can be substantial.

This policy covers Home Healthcare Treatment exclusively through a cashless mode, which is a key feature. After COVID, many health insurance companies are incorporating this into their policies but with several restrictions. However, HDFC stands out by not imposing any apparent limitations in their policy document, except for the condition that the treatment must be medically necessary.

On renewal, you get access to a range of health tests as part of Preventive Health Check-ups regardless of claim history in previous policy. These tests include blood tests, X-rays, and cancer screenings at ERGO network hospitals. However, this must be availed 60 days before policy renewal date.

If you meet fitness goals, such as weekly step targets or daily exercise, you can avail a Fitness Discount of up to 10% on renewal premiums. The process of earning this discount through step targets or daily exercise is simpler compared to more complex wellness programs, like those offered by Star Health.

If you have pre-existing conditions or obesity (BMI above 30), Ergo will apply a premium loading. For a single condition, the loading can be up to 100% of the applicable premium, and for multiple conditions, it can go up to 150%. What stand out here is that the maximum loading is clearly defined at the time of policy purchase, which is an advantage compared to other policies that offer no such clarity. Additionally, there’s a health incentive plan where you can receive a 50% discount on this loading if your health parameters (like HbA1c, BP, thyroid levels, ECG, BMI) are normal based on tests done three months before renewal.

Read More on health insurance

- Narayna Health insurance Aditi

- HDFC optima secure

- New india Yuva Bharat Policy

- IRDA 2024 guidelines on Pre-existing diseases and Moratorium period

Policy also offer worldwide coverage for emergency hospitalisation and major illnesses as add on feature on payment of extra premium.

Koti Suraksha Policy constraints

Policy has only two sum insured options 50 lakh and 1 crore, limiting flexibility for those needing lower coverage.

Certain surgeries and diseases have caps, like a 75k limit for treatments like cataracts or benign tumors. This seems unjust for a policy with such high sum insured options, though there’s an option to waive these through an additional cover.

A 48-month waiting period for pre-existing diseases, which actually violates IRDAI’s latest guideline that caps the waiting period for PEDs at 36 months.

The policy applies a 20% co-payment on all claims for policyholders with pre-existing diseases at the time of purchase. It also applies a 20% co-pay for those over 60 at the time of purchase and another 20% co-pay if treatment is in a higher-premium zone but the policy was purchased in a lower-premium zone. There’s a lack of clarity on the maximum co-payments, so if someone over 60 with a pre-existing condition buys the policy in a low-premium zone and gets treated in a high-premium zone, the total co-pay could add up to 60%.

Policy documents are not properly drafted and there are differences in policy terms between the policy prospectus and brochures, like varying descriptions of PED waiting periods and bonus conditions.

The policy offers a “rebound of sum insured” feature, which means the sum insured can be restored up to the basic amount after it has been used up by a claim. However, there’s a restriction that this restored sum can only be used for chemotherapy and dialysis once in the lifetime of the policy. This limitation seems unfair at such high sum insured also when compared to other policies that do not impose such conditions.

Final Take

This policy is good for those specifically needing a strong personal accident cover alongside health insurance. However, considering its high sum insured options, it might not meet expectations for comprehensive health coverage, especially with restrictions like sub-limits and high co-payments. For those looking for broader health insurance benefits, including OPD coverage and fewer restrictions, exploring other HDFC Ergo products might be more beneficial.