You must have seen advertisements from insurance companies boasting claim settlement ratios of 98-99%. By sheer statistics, it appears that every insurance company is customer-friendly and settles all claims from policyholders. However, choosing a health insurance policy based solely on claim settlement ratio can be confusing and challenging.

In this article, I will discuss whether this is a reliable metric for purchasing health insurance.

What is Claim Settlement Ratio?

First, let’s clarify what a claim settlement ratio is with an example. Suppose an insurance company receives 1,000 claims in a year. If it settles 900 of these claims and 100 remain pending at year’s end, the company’s claim settlement ratio would be 90%.

Now, if every company advertises a near-perfect claim settlement ratio, it implies they are settling nearly all claims they receive. But how is this feasible? Despite these claims, numerous complaints and grievances about insurance companies appear on public forums. Where is the gap? Why does this discrepancy exist? To understand this, we need to revisit the calculation of the claim settlement ratio.

In the example above, the insurance company claimed to have settled 900 out of 1,000 claims. But what does “claim settlement” really mean? Claim settlement by an insurance company includes claims paid, claims rejected/denied, and claims closed. Insurance companies advertise only the claim settlement ratio and not the data on claims actually paid, rejected, and closed out of these settlements. Therefore, from claim settlement figures it’s impossible to determine how many were paid, rejected, or closed out of these 900 settled claims.

Insurance companies reject or deny a number of claims by citing policy terms, conditions, and claim guidelines. Also, insurance companies close a number of pending claims in March, the final month of the financial year, to improve their settlement ratio. These closed claims are then reopened the following year. Both denied and closed claims are counted as ‘claims settled’ for the calculation of the claim settlement ratio.

In the example above, even if the insurance company denied 100 claims and closed another 100, the claim settlement ratio would still be 90%. Therefore, claim settlement is essentially CLAIM DISPOSAL RATIO—claims are disposed of as paid, rejected, and closed by the end of the financial year.

It is not a reliable metric for judging an insurance company’s performance because an insurance company may have rejected/closed a large number of claims, and you may not know this and rely on a claim settlement ratio that appears near perfect.

Claim Repudiation Ratio

If the claim settlement ratio isn’t reliable, what should people look at when selecting an insurance company for health or any other policy? The answer is the claim repudiation ratio, which shows the number of claims denied or rejected by an insurance company compared to the total claims reported in a financial year.

Why is the claim repudiation ratio a better indicator? It reveals the insurance company’s overall approach to claims. A high claim repudiation ratio above the industry average indicates a conservative approach, while a low claim repudiation ratio suggests a more liberal approach. In fact, the claim repudiation ratio should be the key indicator for selecting an insurance company.

It is always better to choose the insurance company first, then the insurance policy. Even the best policy with comprehensive coverage isn’t worth it if the insurance company has a conservative approach to claim payments.

In the example above, if an insurance company rejected 100 out of these 900 settled claims, that constitutes 10% of total claims reported (1000) in a year and 11.11% of the claims settled(900) that year, which is quite high. However, insurance companies typically only advertise a 90% settlement ratio, not the percentage or number of claims denied that year.

How to find the Claim Repudiation Ratio of an insurance company?

Insurance companies share this data in public disclosures. You can see the public disclosures on the Star Health website. Insurance companies file a number of quarterly and annual reports with the insurance regulator IRDAI, and some of these reports are also part of public disclosures. These reports are best for selecting a health insurance company.

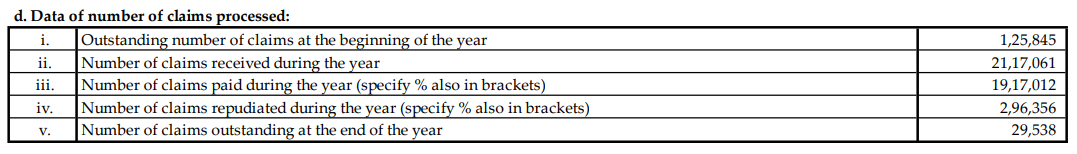

In these public disclosures, you can check the various financial data of insurance companies and other claim-related statistics. Here, we are concerned only with claim-related data. The following data pertains to FY 2023-24.

Based on this data lets try to calculate claim settlement ratio. Total number of claims received during this period (FY 2023-24) as per disclosure are 22133682 (2,117,061+125,845−29,538=2,213,3682)

- Number of claims received during the year: 2,117,061

- Outstanding number of claims at the beginning of the year: 125,845

- Outstanding number of claims at the end of the year: 29,538

Therefore, the total number of claims settled during the period are: (Claims paid + claims repudiated) 22133682

Claim settlement ratio= total claim received during the period / total claims repudiated during the period *100

For star health insurance FY 2023-24 claim settlement ratio is perfect 100% (22133682/22133682*100)

Now, lets check the the claim repudiation ratio, which is calculated as -(Total claims repudiated during the year / Total claims settled during the period)×100

296356/22133682*100 =13.38%

In short, Star Health had a 100% claim settlement ratio but with a 13.38% repudiation rate. I leave it to you to decide which ratio is more reliable. However, all you see in advertisements is the claim settlement ratio. No insurance company likes to publish their claim repudiation ratio.

How much Claim Repudiation Percentage is acceptable?

It’s difficult to pinpoint an exact acceptable percentage, but companies with double-digit claim repudiation rates should be avoided.

There are various reasons for a high claim repudiation ratio. These include strict investigations to prevent fraudulent claims, policyholders submitting incomplete documents, or raising claims without proper knowledge of their policy coverage. However, a conservative approach by the insurance company in paying claims is always a major factor.

Star Health is just one example. You can check the data of other insurance companies in a similar way through public disclosures and examine their claim repudiation ratios.

I hope this post has clarified the confusion on claim settlement ratio and claim repudiation ratio. If you have any query please post in comments.