Bariatric surgery, a weight-loss procedure, has become increasingly important in India due to the rise in obesity-related health issues. Does insurance companies cover the bariatric surgery cost under their health insurance plans? In this post We will analyse this in detail.

As per WHO BMI greater than or equal to 25 is overweight and BMI greater than or equal to 30 is obesity.

Not all the cases of obesity require medical/surgical intervention. Bariatric surgery is the name of procedure which is done in severe obesity conditions. Bariatric surgery is basically a weight loss surgery that involves a group of operations to make change to your digestive system to help you lose weight.

Now the question is, does your insurance cover this bariatric surgery ?

Earlier the weight loss surgeries were not covered under health insurance. Then in 2018 IRDA released a circular which has allowed insurance companies to cover obesity related surgeries as an optional cover.

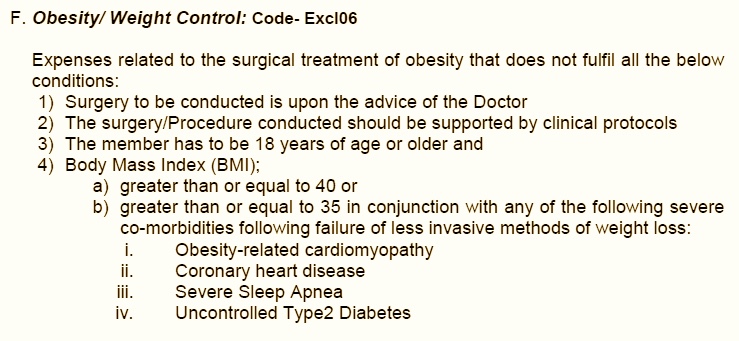

On 22 July 2020 IRDA released a comprehensive “Master Circular on Standardization of Health Insurance Products”. Chapter III of this circular covers the standard wording of certain exclusions in health insurance. IRDA has defined obesity in this part, how an otherwise excluded obesity surgery can be covered under certain conditions.

From the IRDA guidelines it is clear that BMI plays the significant factor in terms of admissibility of claim under a health insurance policy. If BMI is greater than 40 irrespective of other co-morbid condition, bariatric surgery done in this case is covered under health insurance.

However if BMI is in range of 35-39 and person is suffering from any of the mentioned co-Morbid condition- obesity related cardiomyopathy, coronary heart disease, severe sleep apnea, uncontrolled type 2 diabetes, bariatric surgery done in this cases is also covered under health insurance. However here BMI alone is not a defining factor, person must have one or more mentioned co-morbid conditions.

Cases where BMI is below 35 and bariatric surgery is recommended by the doctor, is not covered under health insurance.

Do insurance companies follow IRDA guidelines on obesity/bariatric surgery ?

As this circular was released in 2020 July, by now all the insurance companies have adopted these guidelines in their health insurance products.

However, it is important to note there is no automatic acceptance and incorporation of IRDA guidelines/circular. Insurance companies do the actuarial risk analysis and then adopt the guidelines often by enhancing premium.

While all health insurance policies have incorporated obesity-related guidelines, their implementation is not uniform. Some insurance products, such as Bajaj Allianz Health Guard policy, have included these guidelines but with restrictions such as per case limits, waiting periods, and other limiting factors. Therefore, individuals are advised to carefully review their health insurance policy details before proceeding with the surgery.

However, the majority of insurance companies have listed this under the exclusion section of their policies. For example in oriental insurance Happy family floater policy you will find this clause in exclusion part of policy.

Therefore, it is better to buy an insurance policy which put no limits on the IRDA approved wordings on obesity related coverage.