This article discusses in detail the insurance coverage for balloon sinuplasty. Is it considered a conventional or advanced treatment? Does your policy place any limits on its coverage? I have addressed all these issues here in this article.

Balloon sinuplasty is used to treat chronic sinus problems that have persisted for some time and have not responded to conventional treatments. As the name suggests, an inflated balloon is used to keep the sinus passage open, allowing for better drainage and airflow.

Is balloon sinuplasty covered by insurance?

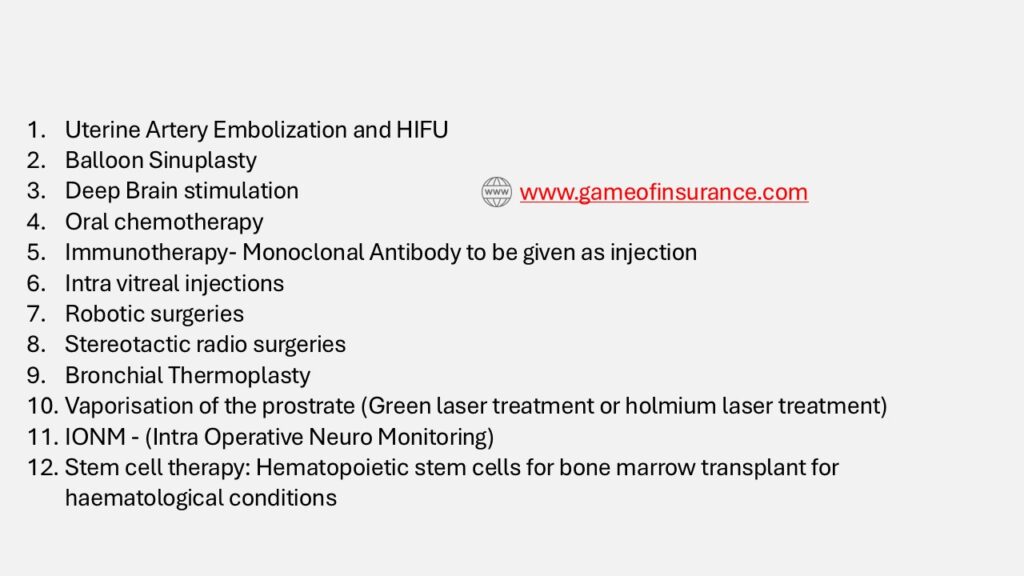

Balloon sinuplasty is considered an advanced treatment by the insurance regulator. The insurance regulator, IRDAI, through various circulars and guidelines, has mandated coverage for certain modern treatments under health insurance. There are a total of 12 such treatments that every health insurance policy must cover, and balloon sinuplasty is one of them. Therefore, it is covered under all health insurance policies offered by any insurance company in India.

Limits on balloon sinuplasty treatment in insurance

Coverage for balloon sinuplasty depends on your health insurance plan. Most health insurance policies cover balloon sinuplasty with a limit, often linked to your sum insured. The higher the sum insured, the higher the limit in your plan. However, some health insurance policies do not impose any limit on the treatment cost for balloon sinuplasty or other advanced treatments.

Here are some flagship policies from various insurance companies, along with their balloon sinuplasty coverage limits:

| Sr. No. | Insurance Polciies | Balloon Sinuplasty tretament limit |

|---|---|---|

| 1 | Aditya Birla Active One economy | Covered but no clarity on limit |

| 2 | Bajaj Allianz My Health Care | Covered up to sum insured |

| 3 | Care Supreme | Covered up to sum insured |

| 4 | Chola MS Flexi Health | Modern treatment cover not mentioned In policy document, therefore no clarity on coverage |

| 5 | Digit Supreme Care Policy | Covered up to 50% of sum insured |

| 6 | HDFC Ergo Optima Secure | Modern treatment cover not mentioned In policy document, therefore no clarity on coverage |

| 7 | ICICI Lombard Elevate | Covered but clarity on limit |

| 8 | Iffcko Tokio Individual Health Protector | Covered up to 50% of sum insured |

| 9 | Magma HDI one health support plus | Covered up to sum insured |

| 10 | Manipal Signa Prime advantage | Covered up to 10% sum insured |

| 11 | New india Yuva Bharat Gold | Maximum up to 5L for a 50L policy |

| 12 | Niva Bupa ReAssure 2.0 | Covered but no clarity on limit |

| 13 | Orienal insurance Youth Eco | For policy up to 10L- 25% of sum insured, and for policy above 10L up to sum insured |

| 14 | Star health comprehensive | 50k to 2L depending upon Sum insured |

As you can see, some health insurance policies cover all 12 modern treatments, including balloon sinuplasty, up to the sum insured limit. However, a few policies have specific limits for balloon sinuplasty treatment.

If the policy document provides unclear or vague information regarding any coverage. It is advisable to either avoid such policies or ensure you get clear, written confirmation of coverage details before purchasing.

How much does balloon sinuplasty cost without insurance?

Various policies cover the treatment cost of balloon sinuplasty up to a certain limit. For example, Star Health’s Comprehensive Health Insurance Policy covers it from ₹50,000 to ₹2 lakh, depending on the sum insured you choose. It’s important to also understand the cost of balloon sinuplasty without insurance, which typically ranges from ₹40,000 to ₹80,000.

Insurance companies have pre-agreed rates with various hospitals across India, known as network providers. To avoid additional out-of-pocket expenses, you should opt for cashless treatment at a network hospital of your insurance company.

If you have any questions related to this, feel free to ask them in the comments section.