The Insurance Regulatory and Development Authority of India (IRDAI) has published its annual report for the financial year 2023-24, offering a comprehensive analysis of insurance sector in India. The report covers key areas like industry growth, new initiatives introduced by IRDAI, and the latest additions to insurance companies and more. I’ve extracted the health insurance highlights from this report to give you a clear view of where this sector stands and what’s on the horizon. Let’s dive in.

Who’s Providing Health Insurance in India?

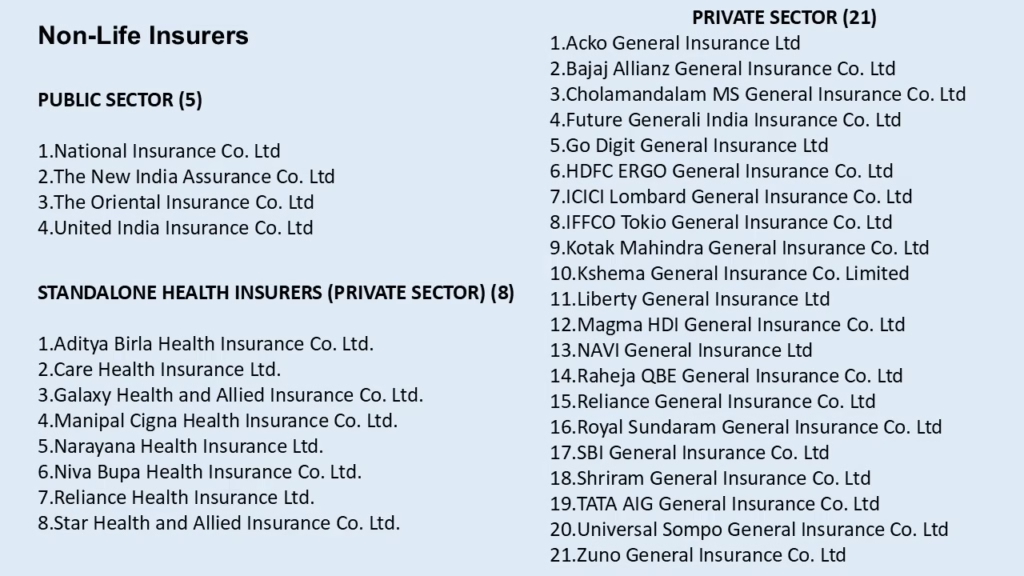

As of the end of FY 2023-24, 33 insurance companies were operating in India’s health insurance segment These fall into three main categories:

- 4 Public Sector General Insurance Companies(PSGICs): Funded by the Government of India, have a strong presence in insurance market for decades. PSGICs operate in general insurance segment offering both health and other type of insurance like – shop insurance, vehicle insurance, Fire insurance etc.

- 8 Standalone Health Insurance Companies: These insurance companies operate solely in health insurance segment.

- 21 General Insurance Companies: These insurance companies operate in general insurance space.

New Players Joining the Game

In FY 2023-24 IRDAI granted licenses to three new insurance companies, adding fresh momentum to the sector.

- Galaxy Health and Allied Insurance Co. Ltd – Licensed on March 19, 2024, this company has already started operations.

- Narayana Health Insurance Ltd. – Licensed on December 28, 2023, it has launched two health insurance plans, ‘Aditi’ and ‘Arya’, now available to customers.

- Kshema General Insurance Co. Limited – Licensed on April 23, 2024, yet to become operational.

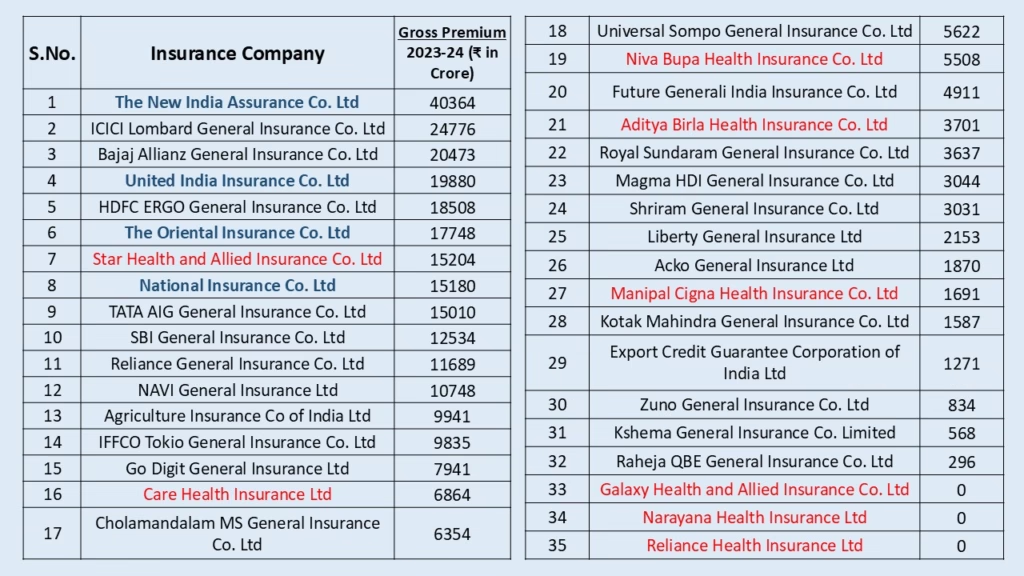

Private insurance companies are surpassing PSGICs in terms of premium and market share. Earlier, all four PSGICs were at the top, but now their market share is gradually declining, and private insurance companies are catching up. However, New India Assurance Company, a PSGIC, still leads the chart in terms of premium and remains the largest general insurance company operating in India.

Star Health Insurance has shown good growth in recent years with the launch of several health insurance products, capturing a significant share of the health insurance business from PSGICs, especially in the retail segment.

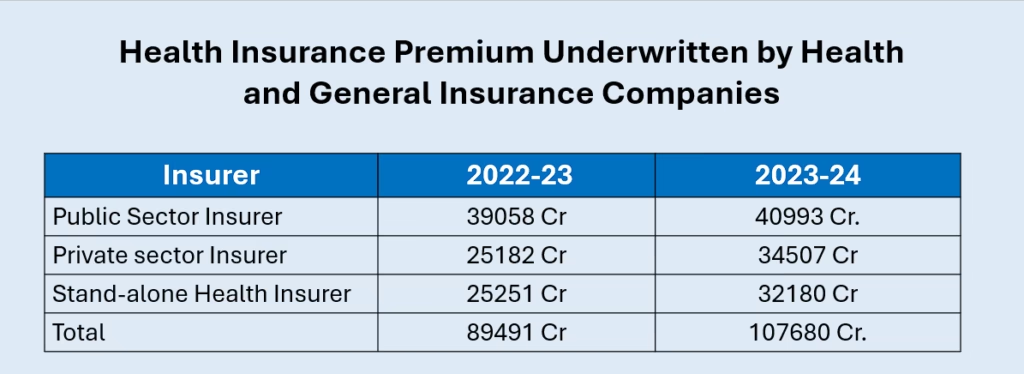

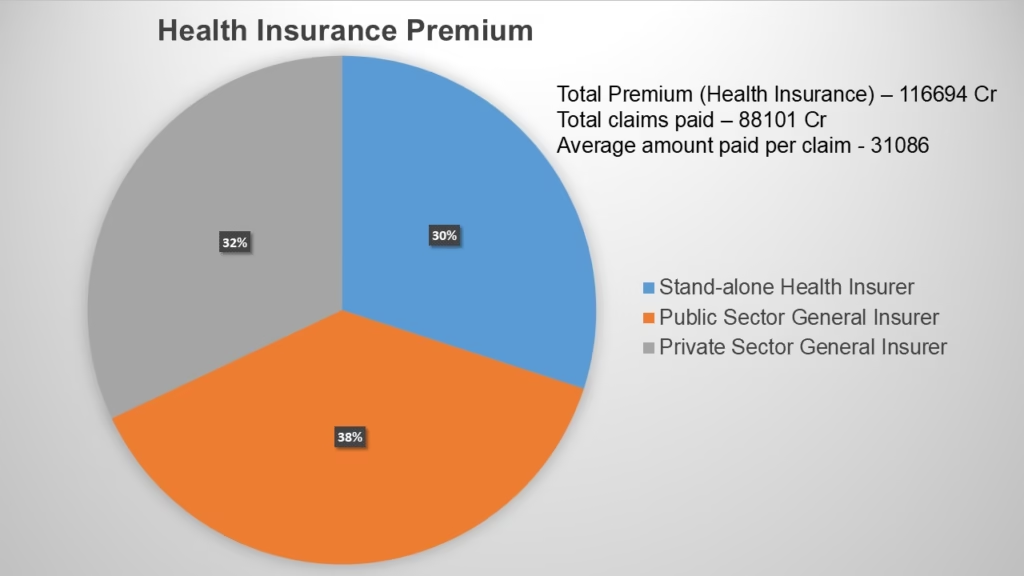

Public sector general insurance companies (PSGICs) hold a 38% market share in health insurance, private insurance companies have 32%, and standalone health insurance companies account for 30%.

PSGICs primarily operate in the group health insurance segment, providing policies for corporate clients like Axis Bank and Accenture employees. While they also offer individual health insurance, their market share in this segment is shrinking each year due to strong competition from private and standalone health insurance companies. Private general and standalone health insurance companies have launched a number of innovative products tailored to market needs and trends. In contrast, PSGICs have been slower to innovate, sticking mostly to traditional health insurance plans. In the retail segment (individual health insurance), the private sector dominates over the public sector, while in the corporate health insurance segment, PSGICs hold the lead.

If we look at the number of lives covered under any type of health insurance or government scheme in India, it is around 57 crore. This means more than 50% of the Indian population is still not covered under health insurance or government schemes—a huge number that also highlights the enormous opportunity for insurance companies in India if they offer affordable health insurance products.

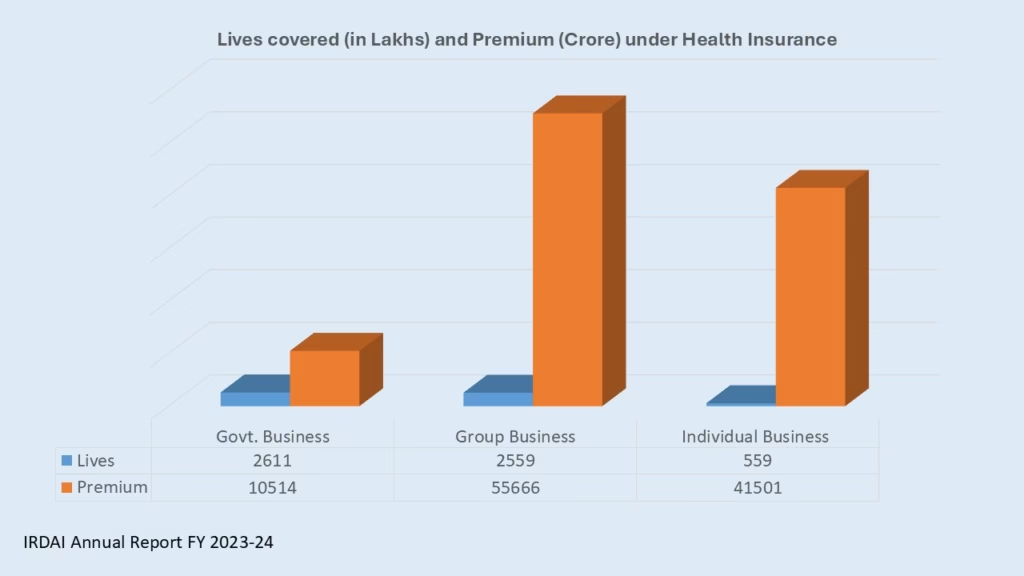

Approximately 26 crore people are covered under government schemes like Ayushman Bharat and other state-specific insurance schemes, making it the largest segment. Group business, mainly corporates buying policies for their employees, is the second largest, covering nearly 25 crore people. While around 5 crore people purchase their own health insurance.

However, when looking at the premium (cost of acquiring health insurance), the premium is lowest for government schemes or businesses. These schemes are mostly funded by state or central governments and operated through insurance companies. These schemes provide limited coverage at low premium rates, mainly due to the standard treatment package rates agreed with hospitals by NHA (National Health Agency). For instance, the Ayushman Bharat Scheme operates on a cashless basis, covering diseases/ailments as fixed packages, with hospitals across India receiving only the standard package amount. There’s no variation in rates, regardless of the hospital category where the policyholder gets treated. This setup helps control overall expenses and keeps the scheme affordable for the state exchequer.

Corporates also cover a similar number of people as government schemes but at a higher premium because they offer wider coverage to employees and purchase policies directly from insurance companies. However, since they cover a large number of employees, they have bargaining power and secure better deals from insurance companies, often through brokers who negotiate bulk rates, especially for younger employees.

The retail segment is priced much higher compared to both government and group business. This is often driven by personal factors like age, health history, and lifestyle. Unlike government schemes, ailments/diseases are not capped, and claim payouts can be significant and unpredictable for individual clients, which is why premiums for individual health insurance schemes are higher.

Insights into Claim Settlement in the Health Insurance Sector

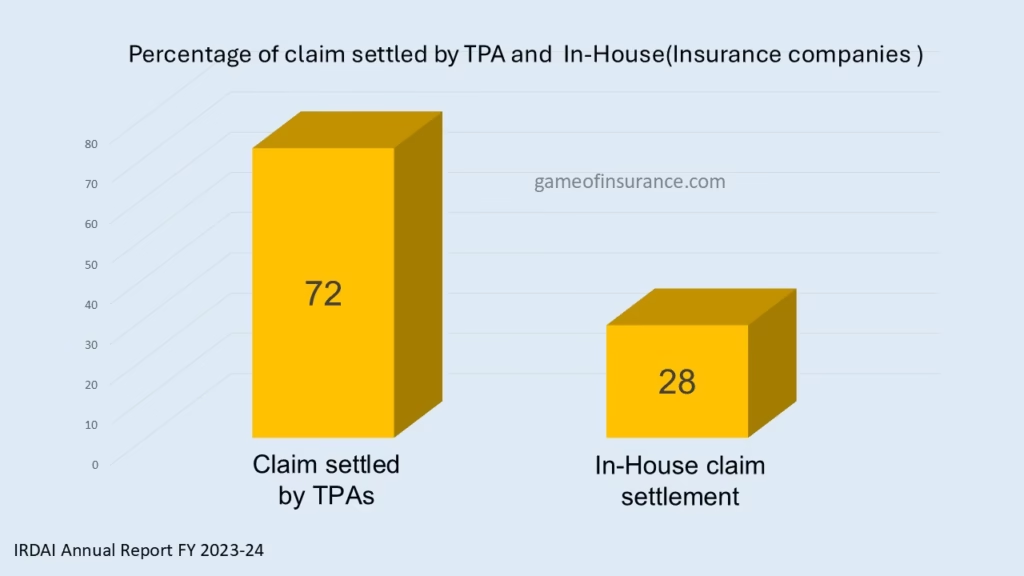

From a claim settlement perspective, Third Party Administrators (TPAs) settle 72% of claims, while the remaining 28% are settled in-house (by insurance company). TPAs are third-party administrators acting as claim-settling agencies for insurance companies. There are currently 20 TPAs licensed by the IRDA operating in the health insurance space. Insurance companies empanel these TPAs and engage them for claim settlements.

All PSGICs settle claims exclusively through TPAs, with no in-house settlement for either individual or corporate clients. However, for private and standalone health insurance companies in India, retail health insurance claims are settled in-house, while corporate policy claims are settled partially in-house and partially by TPAs. Even private health insurance companies with in-house claims settlement teams often engage TPAs for corporate clients, sometimes at the request of those clients. Therefore, TPAs play an important role in the health insurance business.

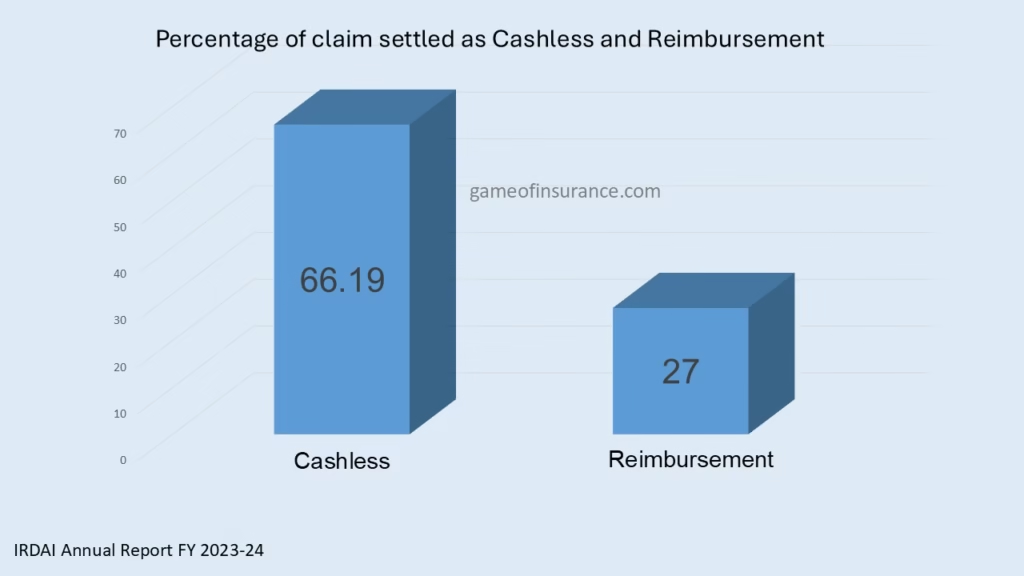

Regarding claim settlement, 66% of claims are settled in cashless mode, and 27% are settled in reimbursement mode, where the claimant submits papers to the TPA or insurance company, and the insurance company settles the claim by paying the hospital bill to the policyholder.

The IRDA has recently pushed for 100% cashless settlements through its “Cashless Anywhere” scheme. This initiative is designed to impact this segment, and we can expect a shift toward more cashless claims in the future.

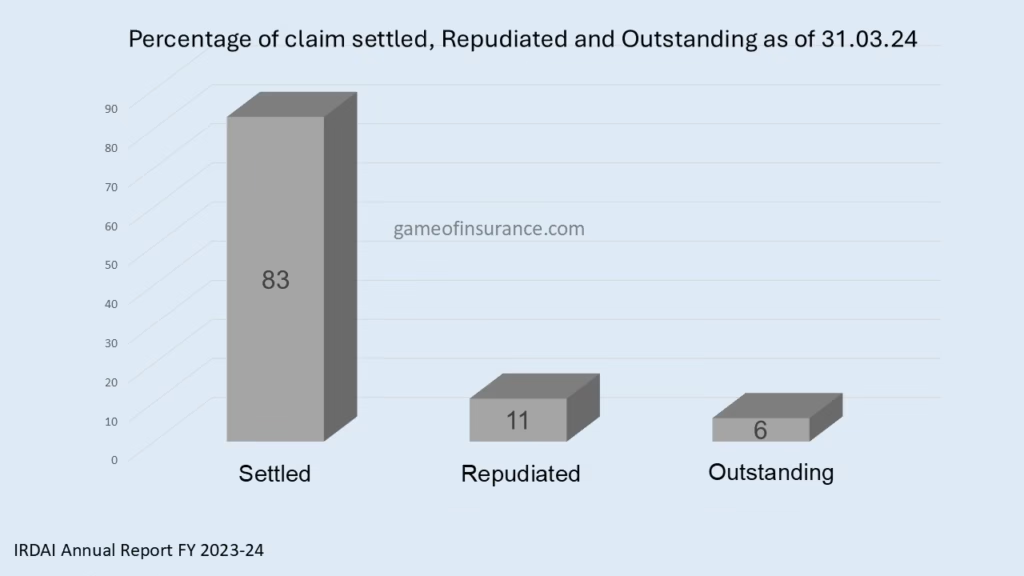

Out of the total claims, around 11% are repudiated by insurance companies for various reasons, and 6% remain outstanding by the end of the financial year. The overall industry average claim repudiation percentage is 11%. However, this number varies across insurance companies. Generally, PSGICs have a lower repudiation ratio compared to private insurance companies.

While the claim repudiation percentage remains within reasonable limits on average, some standalone health insurance companies have higher claim denial rates compared to the industry standard.

Insurance Penetration and Density in India

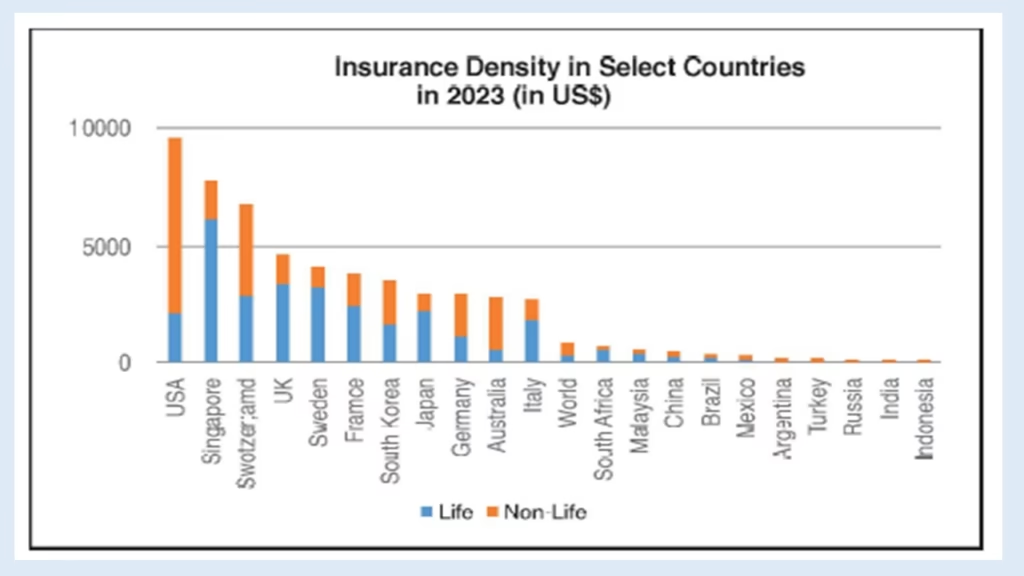

Insurance penetration is measured as the ratio of premium to GDP. In the non-life insurance segment, of which health insurance is a part, penetration in India has remained low at 1%, compared to the global average of 4%. While global Insurance penetration has increased from 4% to 4.2%, in India, despite concerted efforts by the IRDA, insurance penetration has stayed around 1%, the same as the previous financial year.

Several factors contribute to this low penetration in India:

- Low per capita income and limited disposable income for insurance.

- Lack of general awareness about insurance. Although COVID-19 spurred a spike in health insurance growth, post-COVID year-on-year growth has remained more or less stagnant.

Similarly, due to low penetration and India’s huge population, overall insurance density—measured as the ratio of premium to population—is abysmally low. In contrast, the USA has very high insurance density due to high per capita income, awareness, and a well-developed insurance and healthcare sector. India has a long way to go in terms of insurance penetration and density.

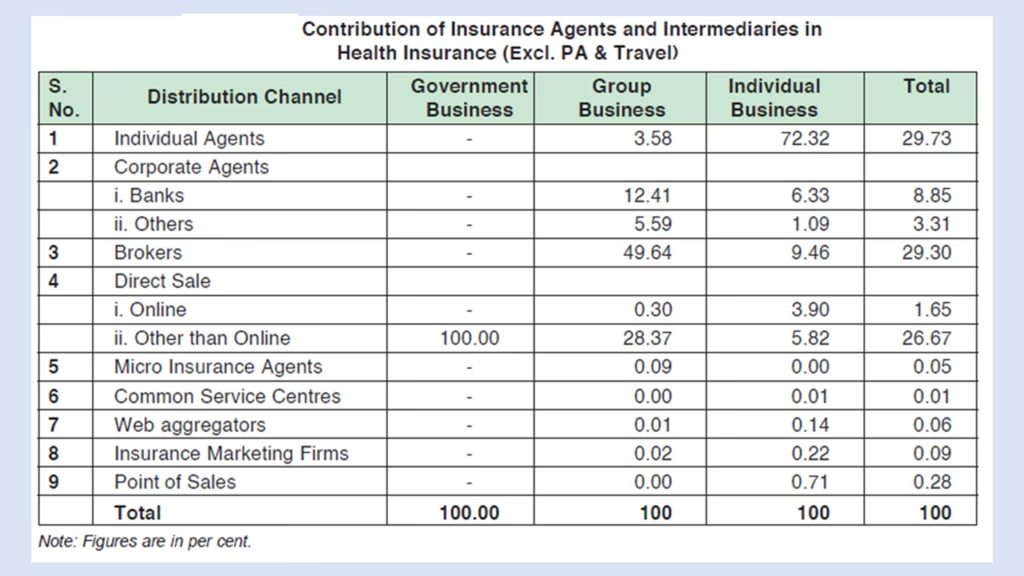

When looking at how health insurance policies are sold, individuals primarily purchase them through agents. Around 72% of health insurance policies for individuals are still sold through agents, despite online marketing and aggregators like Policybazaar. The trend leans toward agents because people often don’t understand the fine print of insurance policies and rely on agents for support, especially during claims.

Brokers constitute the second-largest category through which people buy insurance policies. Banks come in third. Various insurance companies tie up with banks to offer health insurance to bank customers at reasonable rates, a segment known as “bancassurance” in insurance terms.

Online sales account for only about 4% of total health insurance sales, but this is expected to grow with increasing digitization of the economy.

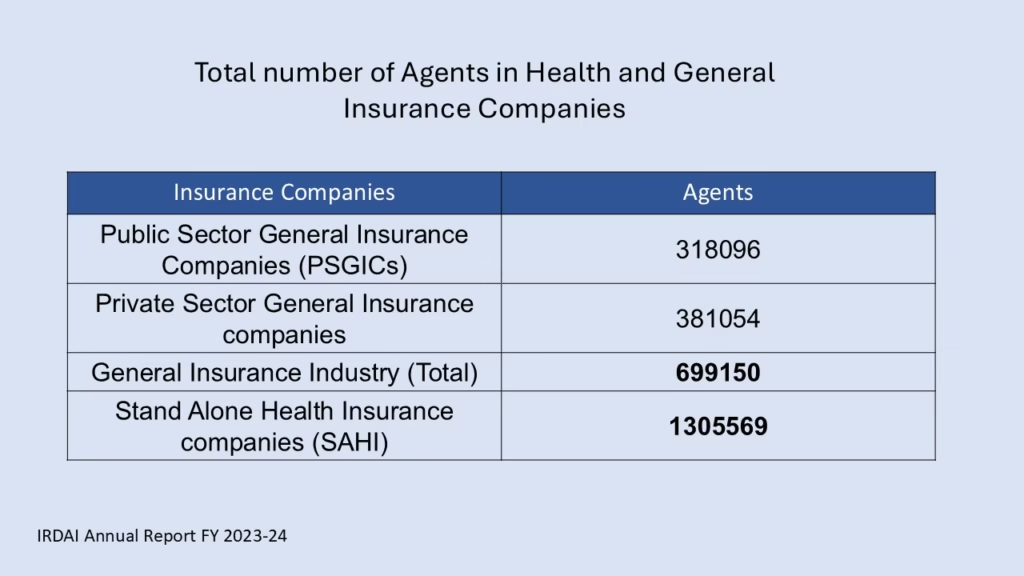

It may be surprising to note that standalone health insurance companies have around 13 lakh agents, nearly double the total number of agents with private health insurance companies and PSGICs (around 7 lakh). Health insurance has grown significantly with standalone health insurance companies, which are engaging agents extensively to sell their policies.

However, they are equally aggressive through their online channels, though they aren’t abandoning the conventional method of selling insurance through agents.

That wraps up the health insurance highlights from IRDAI’s annual report for FY 2023-24. Hope you found these insights useful! Feel free to share your thoughts and questions in the comments.