IRDAI released a master circular on health insurance business in India on May 29, 2024. While some parts of the circular came into force immediately, insurance companies have been given time until September 30, 2024, to modify their existing products in alignment with master circular. At first glance, the circular appears to be customer-centric and aims to address various pain points from the customer’s perspective. In this post, we will review the key points of the circular, their impact on the health insurance industry and policyholders, and the practical implications of its implementation in detail.

Key points and review of IRDAI Master circular on Health insurance Business

1. Emphasis on Diverse Products and Add-Ons for All Needs

IRDAI has asked insurance companies to offer a wide range of health insurance products and add-ons that cater to all age groups, medical conditions, and systems of medicine (modern and alternative, such as AYUSH). The overall aim is to provide a diverse range of health insurance products and add-ons with various options for customers to choose from.

This won’t be very challenging for insurance companies, as they already offer a variety of products targeting different sections of the population, including women, senior citizens, persons with disabilities (PWD), and disease-specific products like cancer or diabetes-focused plans. However, the four public sector general insurance companies—National, Oriental, United, and New India—will need to introduce new products, as they are still offering a limited range of options.

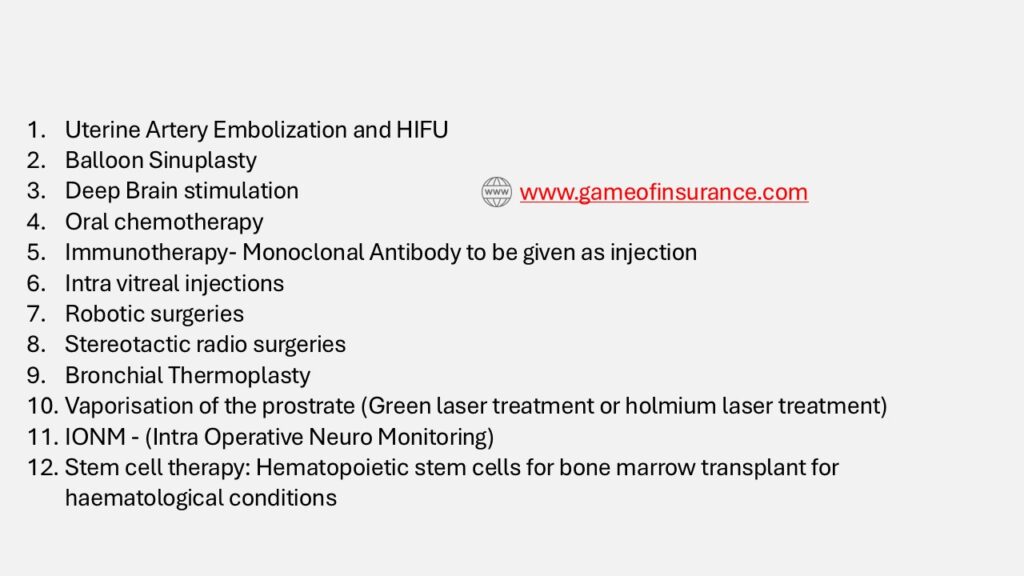

2. Technological Advancements & Treatments

IRDAI had earlier mandated insurance companies to include 12 technological advancements and treatments as part of health insurance products. The master circular again emphasizes the inclusion of more modern treatments but stops short of adding any new technological advancements or treatments to the existing list. The option is left to insurance companies to include any new technological advancements and treatments in their products based on product design.

However, the likelihood of insurance companies independently adding new modern treatments is quite slim, considering the overall adoption of technological advancements by hospitals in India is also limited to a few procedures and many such treatments still in the experimental stage.

3. Customer Information Sheet (CIS)

When you receive your health insurance policy, you will also be provided with a Customer Information Sheet (CIS), which summarizes the important terms and exclusions of your policy. If requested, the insurance company may also provide the CIS in your regional language to help you better understand the terms.

However, while the CIS outlines key terms in brief, it is always advisable to read the full policy document in detail before making a decision to purchase a health insurance policy. Since you will likely continue with your health insurance for many years and pay significant premiums, it is essential to thoroughly understand the coverage. Do not rely solely on the CIS, as it is not comprehensive, and in insurance, much important information is often found in the fine print of the policy.

4. Extension of Free Look Period to 30 days

The master circular on health insurance business has increased the free-look period from 15 to 30 days.

Now, you will have 30 days to review the policy, including its coverages, exclusions, and other details. If you are not satisfied, you can return the policy to the insurance company, which will refund the premium to you. This is a positive move, as 30 days provides ample time to thoroughly understand the policy features.

If the policyholder chooses to return the policy and no claim was made during the 30-day period, the insurance company will deduct administrative costs and any expenses, like the cost of medical tests done before the policy purchase, from the refunded premium.

5. Coverage during grace period

You can purchase a health insurance policy by paying the premium in installments—monthly, quarterly, semi-annually, or annually. If you miss an installment, there is a grace period. For monthly installments, you have a 15-day grace period to make the payment. While it’s best not to miss your payment date, if you do, and you pay within the 15-day grace period, all your benefits, such as No Claim Bonus, waiting periods (for specific conditions and pre-existing diseases), and the moratorium period, will remain intact. You’ll also continue to be covered during the grace period, provided you make the payment within those 15 days. The grace period is 30 days for policies with quarterly, semi-annual, or annual installments.

This is a major shift from the previous IRDAI guidelines. Although a grace period existed earlier also but coverage during that time wasn’t available. Policy coverage would only resume once the pending premium premium/installment was paid.

Let’s understand this with an example: Suppose you have a health insurance policy with quarterly installments, and your premium is due on January 1st. You have until January 30th to pay, which is the grace period (30 days). If you pay on January 30th, your policy continues as usual, protecting all your accumulated benefits like the No Claim Bonus, waiting periods etc.

Under the old guidelines, if you were hospitalized for an illness that began between January 1st and January 29th, the claim would not be payable since the premium hadn’t been paid for that period. However, under the new guidelines, coverage is now available during the grace period. So, if you pay the premium within the grace period, any claims made during that time, including those for illnesses that started between January 1st and January 29th, will be covered.

6. Reduction of Moratorium period and changes to term

Another significant change is the reduction of the moratorium period and the modification of this term. Claims cannot be denied on the grounds of non-disclosure or misrepresentation after the moratorium period that is, after 60 months of continuous coverage.

There are two major changes:

- Reduction in Time Period: The moratorium period has been reduced from 8 years (96 months) to 60 months.

- Inclusion of Non-Disclosure and Misrepresentation: These grounds are now included in the moratorium clause.

This change is particularly relevant given that many insurance companies, especially private insurers, have been rejecting a significant number of claims based on non-disclosure and misrepresentation. Policyholders, who may not fully understand disclosure norms or the intricacies of insurance policies, sometimes fail to disclose or misrepresent information at the time of policy purchase. This has led to claim rejections and even policy cancellations.

- Non disclosure clause in Health insurance

- Health Insurance vs Ayushman Bharat for senior citizens 70+

- Reasonable and Customary charges in Health insurance

The new guidelines offer protection to policyholders against arbitrary rejection of claims on these ground by including these terms under the moratorium clause definition.

However, this does not give policyholders a blank check after 60 months of continuous coverage. There is also a new limitation on the renewal of health insurance policies, which places constraints on this protection.

7. Renewal of Health Insurance Policy

The master circular has also outlined new terms for the renewal of health insurance policies. While most of these terms align with the IRDAI’s previous guidelines, there are some significant changes that will impact related terms, such as the moratorium period.

Previously, renewal was generally available except in cases of fraud or misrepresentation by the insured. The new guidelines add “non-disclosure” to this list, meaning that if the policyholder fails to disclose material facts, the insurance company may also choose to deny renewal.

Interestingly, the terms “misrepresentation” and “non-disclosure” have now been included under moratorium clause. According to the new guidelines, a claim cannot be denied on the grounds of misrepresentation or non-disclosure after 60 months of continuous coverage. This suggests that while a claim cannot be denied after 60 months of continuous coverage, for these reasons but an insurance company may still deny renewal of the policy after such claim has been paid. This approach is consistent with IRDAI’s guidelines.

8. Approval for Cashless and Final discharge requests

IRDAI, through its various guidelines and circulars, is driving towards 100% cashless claims. Insurance companies are urged to cut down on reimbursement claims and concentrate on cashless settlements. The master circular takes it further by requiring insurers to decide on cashless pre-authorization requests within one hour of receipt and to finalize discharge authorizations within three hours of receiving the discharge request from the hospital.

Insurance companies are expected to set up the necessary infrastructure to handle cashless requests within this timeframe. However, this doesn’t seem like a major challenge for insurance companies, especially given the experience they gained during the COVID-19 phase but the responsibility also falls on hospitals and policyholders, as delays in submitting required documents or queries can sometimes cause delays in processing of cashless claims.

While responsibilities and accountabilities for delays in approvals have been clearly set for insurance companies, there is a notable absence of a parallel regulatory body to hold hospitals accountable for their part in the process.

9. Enhanced Scrutiny for Claim Rejections and New Document Collection Rule

Insurance companies are now required to have every rejected claim reviewed by a higher authority, either the PMC or a sub-group called the Claims Review Committee (CRC). They must also provide clear communication to policyholders about any deductions or denials. This adds an extra layer of scrutiny to prevent arbitrary claim denials and ensures that policyholders are informed of the exact policy terms under which their claims were denied.

Additionally, insurers and TPAs are instructed to collect all necessary documents from hospitals, not from policyholders, for cashless claims. However, this requirement could undermine its intended objective. In cases where a disease has a history and further clarification is needed, policyholders, rather than hospitals, are often the best source of this information. If insurers are prohibited from requesting such documents directly from policyholders, it could lead to unnecessary denial of cashless requests and an increase in reimbursement claims, especially for chronic conditions requiring detailed information. This would counteract IRDAI’s goal of maximizing cashless settlements.

10. Ombudsman Award

Insurance companies must comply with Ombudsman awards within 30 days of receiving them. The Master Circular introduces a penalty of INR 5,000 per day for non-compliance, which must be paid to the claimant.

However, the effectiveness of this measure remains to be seen, as similar provisions, such as penalties for delays in claim settlements tied to prevailing bank interest rates, have had limited impact, with many insurers not adhering to them.

IRDAI Customer-centric approach

The Master Circular on Health Insurance Business is undoubtedly a customer-centric move by IRDAI, addressing key pain points from the policyholder’s perspective. The reduction in the moratorium period, extension of free Look Period, coverage during grace period etc are set to positively impact both the health insurance industry and customers.

These changes will also add extra responsibility and financial strain on insurance companies, likely leading to an increase in premiums. Policyholders and potential customers should prepare for higher costs in exchange for better services. That said, this is clearly a move in the right direction, aligning with IRDAI’s vision of “Insurance for All” by 2047. IRDAI appears to be steering things in the right direction with these updates.