Does your health insurance policy cover home dialysis? Dialysis is often recommended for patients with chronic kidney diseases, where the kidneys have sustained irreparable damage. The only way left to replicate the functions of the kidney in such cases is through dialysis.

Generally, Health insurance policies cover expenses related to chronic kidney diseases, including dialysis and, even the cost of a kidney transplant, if the kidney disease develops during the policy period.

There are two methods through which kidney dialysis can be performed:

1. Hemodialysis – This type of dialysis is performed at a hospital as a day care procedure.

2. Peritoneal Dialysis – This type can be done at home by the patient themselves.

Peritoneal dialysis (Dialysis at home) itself has two main types:

1. Continuous Ambulatory Peritoneal Dialysis (CAPD): This type does not require a machine. The patient manually performs exchanges, typically 3-4 times a day.

2. Automated Peritoneal Dialysis (APD): This type uses a machine called a cycler to automatically perform exchanges while the patient sleeps. APD offers more flexibility than CAPD.

Health insurance policies in India generally cover Hemodialysis, which costs around Rs 2000-3000 per session. However, in certain cases, patients may prefer or doctors may prescribe home dialysis, considering the patient’s conditions.

So, does your health insurance cover peritoneal dialysis?

Before July 2020, home dialysis (Peritoneal Dialysis) was not covered by health insurance. Insurance policies provided coverage only for Hemodialysis. Insurance typically covered treatments administered in hospitals as in-patient or day care services. Insurance companies excluded coverage for treatments performed at home due to the challenges in verifying them and the associated risk of abuse and fraud

IRDAI(Insurance Regulatory and Development Authority, India) released Master Circular on Standardization of Health Insurance Products on 22 July 2020. In “Chapter VI: Other guidelines related to exclusions” of this circular IRDA stipulated that

Insurers should not deny coverage for claims of Oral Chemo therapy, where Chemo therapy is allowed and Peritoneal Dialysis, where dialysis is allowed subject to product design.

Master Circular on Standardization of Health Insurance Products on 22 July 2020 (IRDA)

As per the this IRDA circular, insurance companies can’t deny expenses for peritoneal dialysis, but this is subjected to product design(Policy condition). Means expenses related to peritoneal dialysis are payable to the extent and limit, set by specific health insurance policy, but the coverage for peritoneal dialysis (Home Dialysis) can not be denied out rightly by incorporating home dialysis as exclusion in policy T&C.

Following these guidelines, insurance companies were asked to update their policy terms and conditions to comply with regulatory requirements. However, the actual implementation falls short of the intended spirit outlined in this circular, resulting in insurance companies continuing to deny claims related to peritoneal dialysis.

Reason for denial of peritoneal dialysis claims even after IRDA guidelines

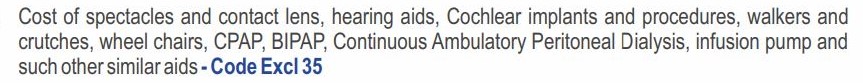

1. Few insurance companies are still continuing with policy terms that exclude peritoneal dialysis coverage or creating an unnecessary ambiguity. For example star health Family health optima policy has following as an exclusion:

2. Insurance companies have incorporated the Dialysis coverage in policy terms and conditions but denying peritoneal dialysis claim when raised by policyholder under the pretext that Dialysis coverage in policy includes only hemodialysis and not the dialysis done at home(Peritoneal Dialysis).

Policies providing peritoneal Dialysis Cover

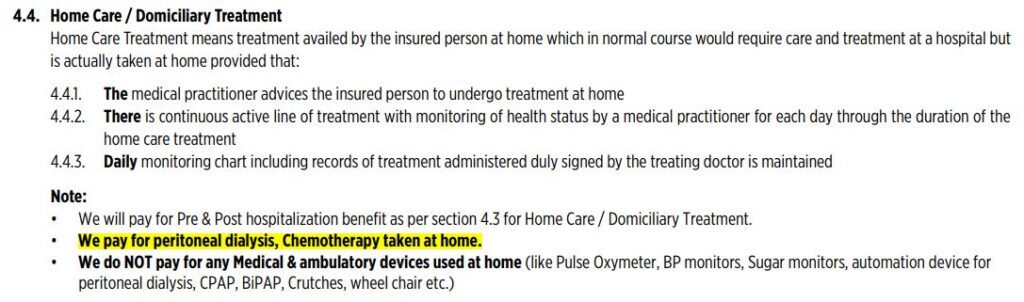

Some health insurance policies now explicitly address the coverage of dialysis at home. These policies typically include a “Home Care Treatment Cover” that clearly outlines the scope of coverage, specifying the allowed types of treatment and procedures while also identifying any excluded items.

For example Niva Bupa ReAssure 2.0 covers the peritoneal dialysis by incorporating the following term.

There are other health insurance policies too that provide this cover, provided the policyholder produce and able to verify the cost incurred on the treatment.

What is covered under peritoneal dialysis?

Insurance companies that provide coverage for home dialysis typically cover the cost of dialysis fluid and catheters. However, the cost of the Dialysis Machine used in Automated Peritoneal Dialysis (APD) is not reimbursed.

When seeking reimbursement for peritoneal dialysis claims from an insurance company, it’s essential to take the following precautions:

- Understand Your Policy: Thoroughly review your health insurance policy to understand the coverage related to peritoneal dialysis. Pay attention to any specific terms, conditions, and exclusions.

- 2. Pre-Authorization: Before undergoing peritoneal dialysis, obtain pre-authorization from your insurance provider. Follow the approved procedure to ensure smooth reimbursement.

- Documentation: Maintain detailed records of your dialysis treatments, including invoices, prescriptions, medical reports, and receipts. These documents will be crucial when filing reimbursement claims.

- Timely Claims Submission: Submit your reimbursement claims promptly. Delayed submissions may lead to complications or denial of claims.

- Itemized Bills: Ensure that your bills are itemized, clearly specifying the peritoneal dialysis-related expenses. This transparency helps streamline the reimbursement process.

Peritoneal Dialysis claim Denied. What to do?

Despite regulatory guidelines, insurance companies continue to deny peritoneal dialysis claims by citing arbitrary policy terms. What steps can a policyholder take in such situations?

Firs of all familiarize yourself with the coverage and exclusions of your health insurance policy, which you’ve been paying premiums for over the years. If an insurance company denies your claim unjustly, reach out to their grievance cell. Provide clear details and evidence related to your peritoneal dialysis treatment coverage by citing IRDA circular. If the issue remains unresolved, escalate it to the Insurance Regulatory and Development Authority of India (IRDAI) through their online portal, Bima Bharosa .Finally, consider seeking assistance from relevant consumer forums if necessary.

Remember, advocating for your rights as a policyholder is crucial, especially when it comes to critical healthcare needs.