Star Health Insurance Company’s comprehensive health insurance and family health Optima policies stand out as top-selling insurance products in the Indian market.

The similarities between these two policies creates a lot of confusion among customers, making it challenging for them to decide which policy to choose.

I have emphasized the difference in coverage between these policies, as well as comparing their premiums. Since the post is extensive and thorough, it demands patience to read through.

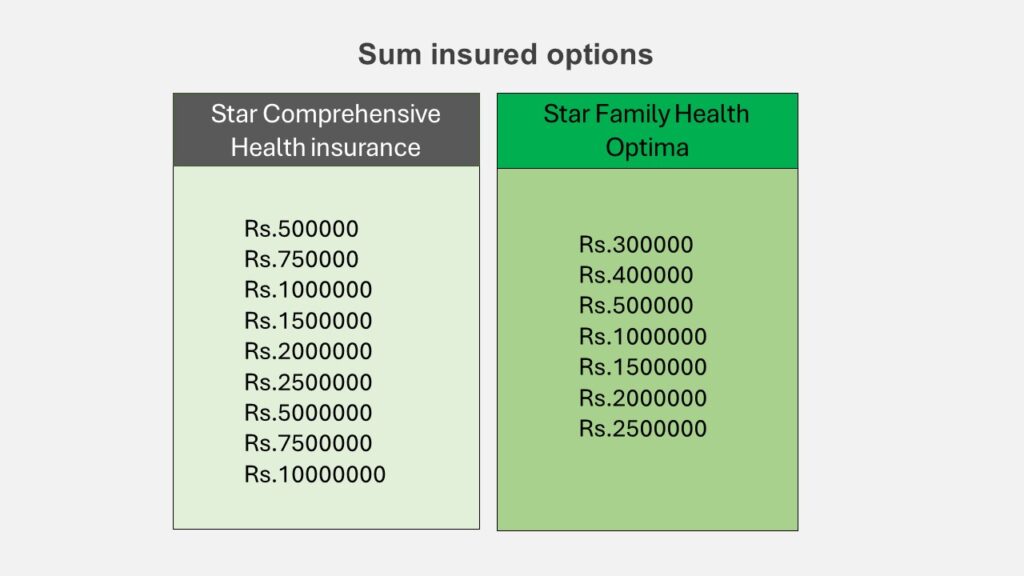

Sum insured options

Comprehensive health insurance policy offers more sum insured options ranging from 5 lakh to 1 Cr, while Family health optima has maximum cover limit of 25 lakh only.

FHO (family health optima) policy also offer cover limit as low as 3 lakh and 4 lakh which is not available in comprehensive policy.

Waiting periods

The Star Comprehensive Health Insurance Policy includes a 36-month waiting period for pre-existing diseases/conditions that have been disclosed in the proposal form and agreed to be covered by Star Health.

There is also an additional optional cover in star comprehensive policy to buy back this waiting period and reduce it to 12 months only.

On the other hand, the Family Health Optima Policy has a longer waiting period of 48 months for pre-existing conditions, and it does not provide any optional cover to shorten this waiting period.

Cumulative Bonus

Both the Comprehensive and Family Health Optima (FHO) insurance policies offer an increase in the sum insured (cover limit) as a bonus on claim-free renewals, up to a maximum of 100% of the base sum insured.

If you have star health Comprehensive insurance policy:

- With a Sum insured of 5 Lakhs, you are eligible for a 50% increase in the sum insured on your next claim-free renewal.

- If your Sum insured is 7.5 Lakhs or more, you can expect a 100% increase in the sum insured on your next claim-free renewal.

On the other hand, the Family Health Optima policy offers:

- A 25% increase in the sum insured in the second year.

- A subsequent 10% increase in the sum insured on each claim-free renewal thereafter.

Co-payment

If you purchase either of these policies at the age of 61 or older, a co-payment will be applied to every claim you make.

In the case of the Comprehensive policy, a 10% co-payment is applied to the admissible claim amount. However, for the Family Health Optima policy, a higher co-payment of 20% is applied to the admissible claim amount.

Sum insured Restoration

Both the Comprehensive and Family Health Optima (FHO) policies offer an immediate restoration of 100% of the sum insured after it has been exhausted due to claim/s. However, there is a crucial difference in how this restored sum can be used in these two policies.

For the Comprehensive insurance policy, the restored sum insured, which is 100% of the base sum insured, can be used for any subsequent hospitalization event (not current hospitalisation), regardless of whether a claim has already been made for that particular disease.

On the other hand, the FHO policy offers a 100% restoration of the sum insured up to 3 times, immediately after it has been exhausted. However, this restored sum insured can only be used for illnesses or diseases that are unrelated to the ones for which claims have already been made, as per the policy terms.

This term ‘unrelated’ in reference to the illnesses or diseases for which claims were made, creates a significant difference in coverage. The reason being, the likelihood of hospitalization within a year for different illnesses is relatively low. It is usually chronic illnesses that require frequent hospitalization, and these are excluded from coverage due to this term. Therefore, the probability of utilizing 100% of the restored sum insured in the case of the FHO policy is lower.

Recharge Benefit

In Family health optima policy if you use up all your coverage under the policy during the policy period, you can get extra coverage up to the limits shown in a table. You can use this extra coverage even for the same hospital stay or for treating the same disease or injury that the policy has already paid for.

Comprehensive Policy does not offer such benefit.

Bariatric surgery cover

Bariatric surgery, essentially a procedure for weight loss, has been defined in terms of coverage scope by the IRDA through its master circular on Standardization of Health Insurance Products dated 22 July 2020. Since then, Insurance companies have incorporated this definition into their health insurance products. However, some health insurance policies have also introduced additional terms to limit the coverage of obesity-related expenses as defined by the IRDA.

For instance, the Star Health Comprehensive health insurance policy includes the IRDA-defined term but also adds another term that restricts the coverage scope under this IRDA-defined term.

This additional term introduces a waiting period of 36 months and limits it to cashless mode only. Besides this, overall expenses payable for obesity related surgeries are limited to certain specific limits (2.5 Lakh for policies with sum insured from 5 Lakh to 15 Lakh & 5 Lakh for polices having sum insured above 15 Lakh)

Family Health Optima policy provides coverage for obesity-related issues strictly as per IRDA guidelines and does not limit the coverage by adding any conflicting term in this product.

OPD cover

The Star Comprehensive health insurance policy offers coverage for Outpatient Department (OPD) services, subject to the specific limits. However, the Family Health Optima policy does not provide OPD coverage.

Organ transplant cover

Under the Comprehensive Policy, the policyholder is covered as an organ recipient up to the limit of the sum insured. Any complications that the donor may experience post-donation are covered up to the sum insured.

In contrast, the FHO policy provides coverage for the policyholder as an organ recipient up to either 10% of the sum insured or 1 lakh, whichever is less. However, it does NOT provide coverage for any complications that the donor may experience post-donation.

Maternity cover

Comprehensive policy provides Maternity cover, however there is a Waiting period of 24 months and during that period both husband and spouse must be covered under the policy. Maximum 2 deliveries expenses during lifetime of insured are payable. Pre and post natal in-hospitalisation expenses covered but within these maternity limits.

Family health optima does NOT provide maternity coverage.

New Born cover

For the Comprehensive policy, you need to pay an extra premium if you want to add a newborn in the midterm of the policy. The coverage limit for the newborn is between 1Lakh and 2Lakh, depending on the Sum insured.

For the Family Health Optima policy, coverage for a newborn begins from the 16th day and is up to 10% of the total amount insured, with a maximum limit of 50k.

Congenital diseases/Anomalies cover

A congenital disease, also known as a birth defect, is an abnormality in physical structure or function that occurs while the baby is developing in the mother’s womb. These abnormalities can be external, visible on the body, or internal, affecting the body’s internal structures.

The Comprehensive Policy provides coverage for external congenital diseases up to 1Lakh-2Lakh, depending on the sum insured. However, there is a waiting period of 2 years for internal congenital diseases.

On the other hand, the FHO policy does not cover external congenital anomalies. While there is a 2 year waiting period for internal congenital diseases, there is no waiting period for new-born with internal congenital diseases.

Infertility Treatment Cover

Family Health Optima policy however doent provide coverage for maternity but covers Assisted Reproduction Treatment. This cover encompasses procedures such as Intrauterine Insemination (IUI), Intra-Cytoplasmic Sperm Injection (ICSI), In-Vitro Fertilisation (IVF), and Testicular/Epididymal Sperm Aspiration/Extraction (TESA/TESE).

Expenses up to 1Lakh to 2Lakh payable depending upon sum insured.

Comprehensive policy does not cover Assisted Reproduction Treatment expenses.

Accidental Death and permanent total disablement benefit:

A comprehensive health insurance policy includes accidental death and permanent total disablement benefit. If an insured person experiences accidental death or permanent total disablement within 12 months following an accident, the policy provides compensation equal to 100% of the base sum insured. The coverage is available for one insured person, as chosen by the proposer at the time of policy purchase.

The FHO policy does not offer such coverage. However, if the insured person is involved in a road traffic accident that results in in-patient hospitalization and depletes all the sum insured under the policy, the policy provides an additional 25% of the sum insured, up to a maximum of 5 Lakh for that event.

The Family Health Optima (FHO) plan provides a broader range of options to decrease the premium through various discounts. For instance, under the Star Wellness Program, which rewards insured individuals for maintaining fitness criteria, FHO offers a 20% discount on premium renewal, compared to the 10% offered by a comprehensive health insurance policy.

In addition to this, FHO provides discounts on long-term policies, claim-free periods of 3 years, and treatments at network providers (hospitals) recommended by Star Health. These options are not provided in the comprehensive policy.

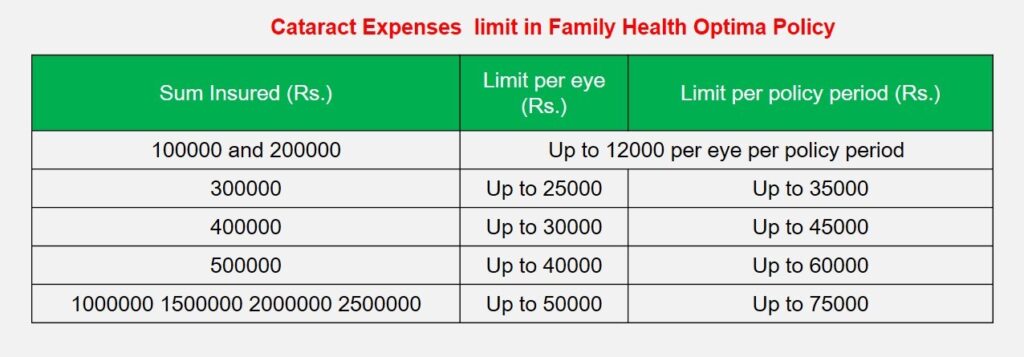

Disease wise sublimit

Comprehensive Insurance Policy does not set any limit on expenses related to cataract treatment.

The Family Health Optima policy imposes a limit on cataract-related expenses, as outlined in the table below.

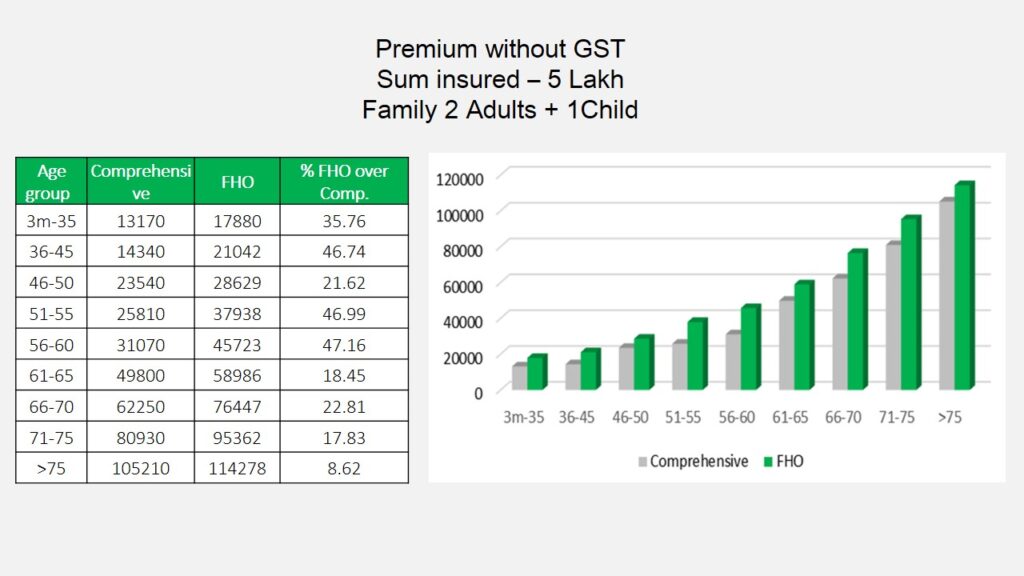

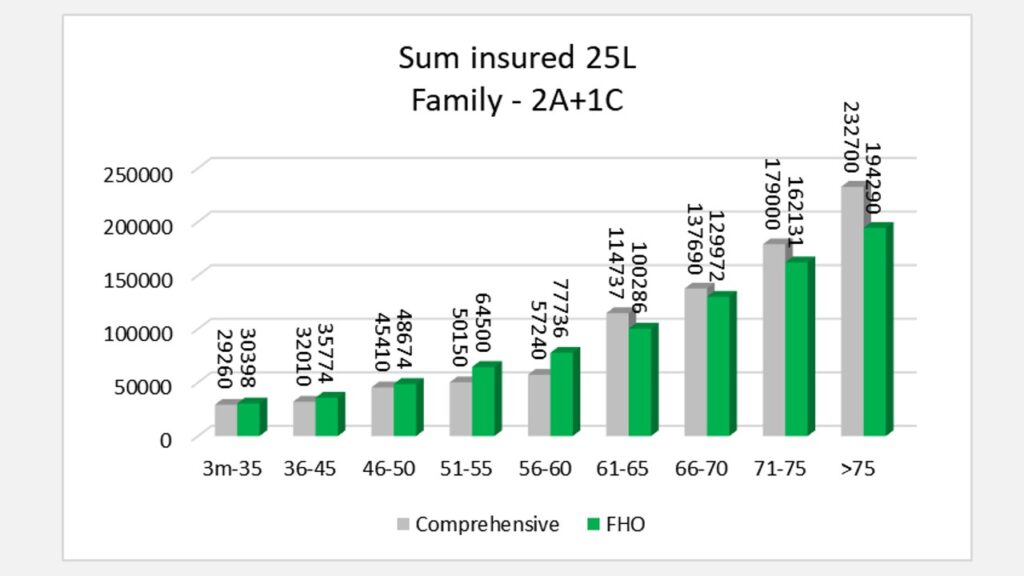

Premium comparison of star comprehensive and Family health optima

In general, the comprehensive policy offers broader coverage than the Family Health Optima. Interestingly, the premium for the Family Health Optima is higher than that of the comprehensive policy, particularly for lower sum insured amounts like 5 lakh and even for larger sum insured amounts for individuals under 60 years of age.

For a standard comparison, I evaluated the premiums of these two policies for a family of three, comprising two adults and one child, across various sum insured categories.

It’s evident that the premium for the Family Health Optima is more expensive than the comprehensive health policy across all age brackets for a policy of 5 Lakh.

When we compare the premiums of the 25 Lakh policies of both the Comprehensive and FHO policies, we observe a consistent pattern. The Family Health Policy premium is higher than the Comprehensive Health Insurance for individuals up to 60 years old. However, for those aged 61 and above, the Comprehensive premium surpasses the FHO.

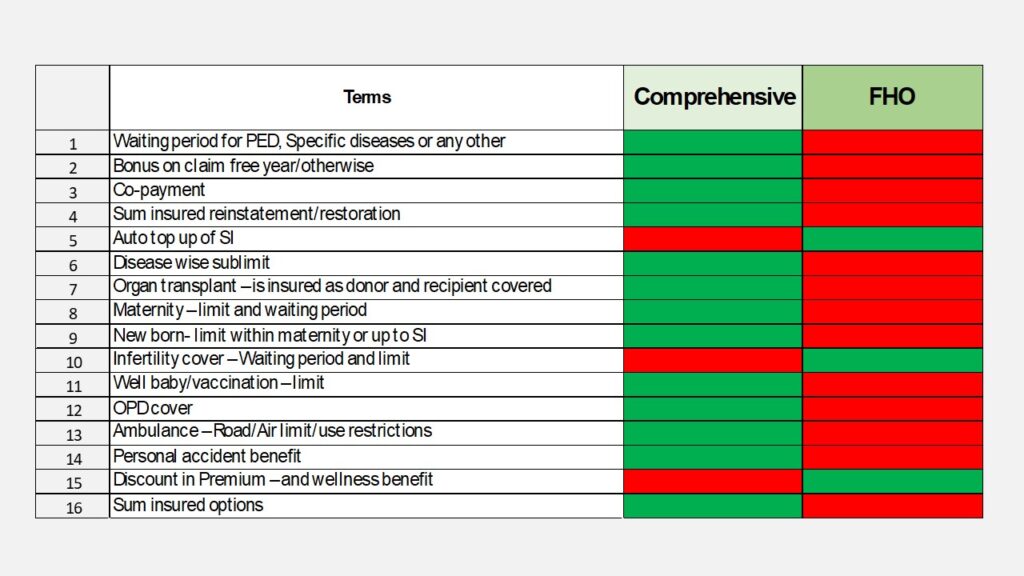

In our discussion, we examined around 16 terms, excluding the premium. We found that the Comprehensive policy outperforms the FHO in 13 of these terms, while the FHO is superior in the remaining 3.

Given the extensive coverage offered by the Comprehensive policy, it seems logical to prefer it over the Family Health Optima.

Additionally, the family health optima policy offers less coverage and comes with higher premiums compared to comprehensive health insurance.