National Insurance Parivar Mediclaim is a floater health insurance plan where you can choose a sum insured between ₹1 lakh and ₹10 lakh for the entire family. In this post, we will discuss the key positive features and limitations of this policy in detail.

Good features of this policy

Policy covers hospitalization expenses for 45 days prior to admission and 75 days after discharge. This includes expenses for consultation, diagnostics, and even medicines. Generally, the cover for pre-hospitalization and post-hospitalization is limited to 30 and 60 days respectively, but here it is extended to 45 and 75 days, which is indeed a good extension.

In Parivar Mediclaim policy for hypertension, diabetes and related complications, and cardiac conditions, the waiting period is just 90 days. In this regard IRDAI introduced guidelines in 2020, asking insurers to cover these three conditions (if not pre-existing) after 90 days of policy inception. So, in that sense, this policy is compliant. Many health insurance policies still haven’t implemented this guideline.

The policy provides coverage for maternity expenses, newborn care (up to 90 days under the maternity limit), and even ART (Assisted Reproductive Treatment). However, the waiting period is 36 months, which feels a bit high compared to the 24 months offered by many other policies. Also, it’s not an optional feature but a default cover. If you’re young and newly married, this adds good value.

The policy explicitly covers HIV/AIDS and mental illnesses (with certain conditions). This is also in line with IRDAI’s directives, which require insurers to offer coverage for such conditions. Yet, many health insurance policies have still not implemented this regulation.

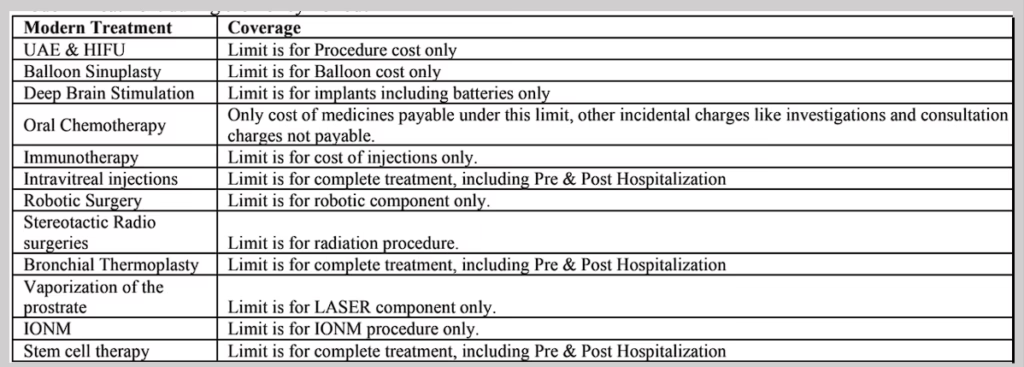

Modern treatments are covered under this policy, but with a cap of 25% of the sum insured per procedure. What really makes this policy better in this area is the clarity it offers. It clearly mentions what’s covered and what’s not when it comes to modern treatment methods. You can check the table below for more details. Such clarity is usually missing in many other health insurance policies.

Generally Health insurance policies do not provide coverage to professional sportspersons, or they exclude injuries from participation in adventurous sports. Even for non-professionals, injuries from adventure sports like bungee jumping, river rafting, or skydiving are often not covered. But here, the National Parivar Mediclaim Policy covers medical expenses for non-professional participation in hazardous or adventure sports. The maximum claim amount for such an event is capped at 25% of the sum insured. Still, providing this kind of coverage is a positive step.

The policy also offers good optional covers such as OPD expenses cover and critical illness cover. However, one must be aware of the premium charged for OPD coverage. For example, if you opt for ₹10,000 OPD cover for a year, you’ll need to pay around ₹6,000 as premium — which is 60% of the OPD amount. OPD covers generally come with high premiums, and while it’s optional here, you can skip it if you find it too expensive.

In addition to these, National Insurance also offers useful add-on covers like home care treatment and non-medical expenses cover. You can opt for home care treatment from ₹10,000 to ₹50,000 and non-medical expenses are capped at 10% of the sum insured. Still, both covers offer good value and should be considered at the time of policy purchase.

Things to Keep In Mind before buying

The policy is available only up to a ₹10 lakh sum insured. This may not be sufficient for metro cities where medical inflation and treatment costs are quite high. It would have been better if sum insured options could have been up to at least ₹50 lakh.

The waiting period for pre-existing diseases is 36 months, which is on the higher side. There’s no option to reduce this waiting period, neither through optional covers nor otherwise.

Additionally, the policy has a waiting period of:

- 2 years for LASIK eye surgery,

- 3 years for obesity-related treatments, and

- 3 years for stem cell therapy (only for hematopoietic stem cells for bone marrow transplant for hematological conditions).

There are a number of health insurance policies which do not have such waiting periods for these treatments. Specific Stem cell therapy, is now part of modern treatment methods therefore, this waiting period could have been avoided.

The policy has a sum insured reinstatement feature, where if the insured amount is exhausted due to a claim, it is restored to its full value for the remaining policy period. However, this restored amount can be used only for illness/injury that were not claimed earlier, which limits its usefulness.

Policy has no-claim bonus which is 5% per year, up to a maximum of 50% of the sum insured. This is on the lower side compared to other policies that offer better no-claim bonuses even up to 200% of sum insured. Policy needs better incentivization for those who are renewing it claim free year on year.

One unique optional cover is available for people with diabetes or hypertension. The policy allows coverage for only diabetes, only hypertension, or both — without a waiting period, but only for the base condition, not for its complications. The catch is a co-pay of 10% for one condition, and 25% for both, which is quite high. So this optional cover may not be worth it considering the limited scope and the high co-pay.

The policy uses zone-based premium and imposes a high co-pay if you buy it in a lower premium zone but seek treatment in a higher premium zone. This creates an unnecessary limitation for treatment access.

This was all about national Parivar Mediclaim policy. I hope you must have gained clarity on this policy after reading my post. If you still have queries please post in comment section of this post.