MD India is a Third Party Administrator (TPA) that settles health insurance claims on behalf of insurance companies. Private insurance companies, however, typically have their own in-house claim settlement teams. As a result, for the majority of their health insurance business, they do not rely on TPAs. In some Group Mediclaim Policies, corporations which are buying health insurance for their employees may specifically request the services of a TPA instead of the insurance company for claims settlement. Therefore, in private insurance, TPAs are generally engaged mainly for corporate health insurance business.

On the other hand, public sector general insurance companies, which do not have in-house claim settlement teams, rely entirely on TPAs to handle the settlement of health insurance claims for both retail and corporate health insurance policies.

MD India Health Insurance TPA Private Limited

Mr. Brij Sharma is the founder and director of MD India Health Insurance TPA Private Limited. He established MD India in 2000, making it one of the first licensed TPAs in India. At that time, the insurance industry was growing in an unregulated environment.

As MD India is a TPA, their role is limited to settling health insurance claims and providing other services such as health check-ups for individuals on behalf of insurance companies, either during the policy period or before the purchase of a policy, as per the insurer’s requirements.

It’s important to note that MD India, or any other TPA, is not only engaged with general or health insurance companies. They are also involved with various life insurance companies to handle business related to health coverage within life insurance policies.

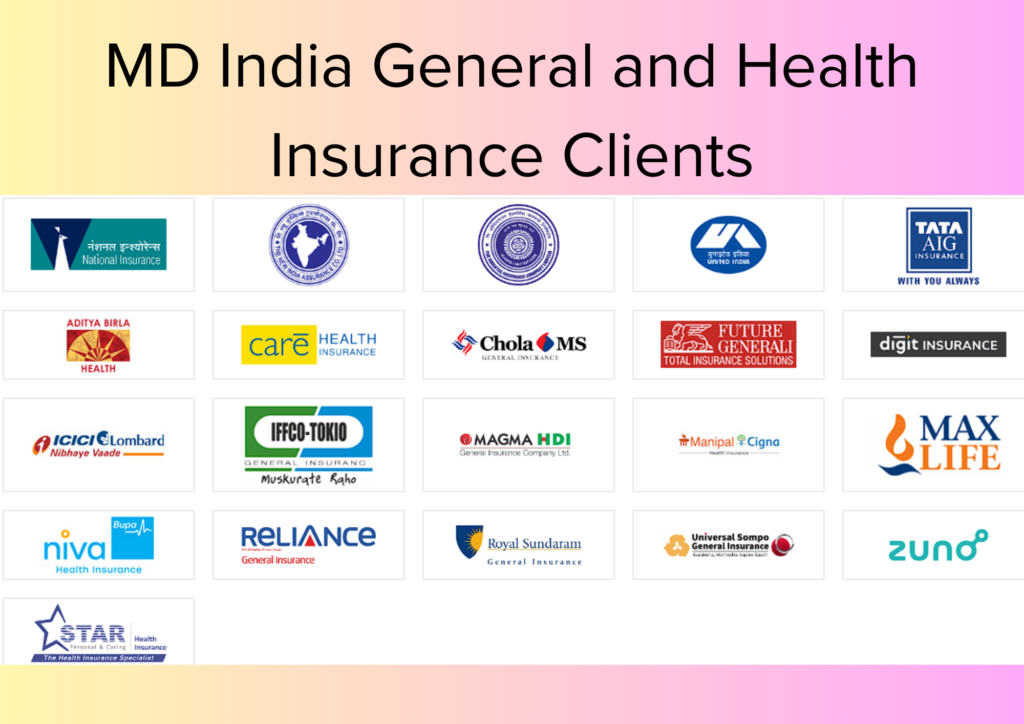

MD India TPA is currently engaged with 21 general and health insurance companies, providing them with Mediclaim services.

MD India TPA is also engaged with 16 life insurance companies in PIMS (Policy Issuance and Management System)

Branch Offices of MD India TPA

IRDAI, through its health insurance regulations, has given policyholders the option to choose a TPA of their choice for health insurance policies that are serviced by TPAs. If you are buying a health insurance policy from any of the public sector general insurance companies (New India Assurance, United India Insurance, Oriental Insurance, National Insurance), you have the option to select a TPA from the given list of TPAs.

At that time, it becomes important for you to know whether the TPA has a physical presence in your area or not. In an era of a hyper-digital environment where the human touch is missing in the service sector, a physical office of the TPA is quite helpful when you are raising a claim request and dealing with the process later on.

MD India has one of the largest networks of 122 physical offices across India in various states, with the maximum number of offices being in Gujarat (18), Maharashtra (26), and Tamil Nadu (23).

Therefore, you can check the list of offices here and choose the TPA if you have a physical office near you.

MD India Health Insurance Hospital List

TPAs have their own network of hospitals and can also empanel new hospitals to provide services to policyholders of the insurance companies they are associated with. Being a large TPA, MD India has a vast network of hospitals across India. However, it is important to note that you cannot choose any hospital from MD India’s network for treatment, as each insurance company has its own guidelines and policies that define the number of hospitals they need in a particular region from MD India’s network.

For example, public sector general insurance companies have their own network of hospitals called GIPSA PPN (Preferred Provider Network) in 13 major cities, including all metro cities. These companies prefer using only their GIPSA PPN network in these 13 cities and discourage the use of any TPA network, including MD India’s network.

Similarly, private insurance companies like Star Health have their own network of hospitals. For retail health insurance business, they use their own network hospitals and do not rely on the TPA network. However, sometimes these private insurance companies prefer MD India’s network of hospitals for servicing their corporate clients who have been given group Mediclaim policies.

Therefore, the network of each insurance company is specific to what they have developed on their own, along with a part of MD India’s hospital network they use for specific clients or to meet the requirements in a particular geography where the insurance company’s network hospitals are not available.

Insurance companies blacklist certain hospitals due to various reasons such as fraud, abuse, inflated billing, and other malpractices. Insurance companies typically recommend that their policyholders avoid receiving treatment at these hospitals. A list of such hospitals is available on the insurance company’s portal, as well as on the TPA’s website when the insurance policy is serviced by a TPA. Policyholders must be aware of these hospitals to avoid any hassle during claim payments. However, in case of an emergency, the policyholder may receive initial treatment at these hospitals until they are stabilized, after which they must transfer to another hospital that is not on the insurance company’s or TPA’s list of excluded providers.

MD India TPA also has a list of excluded providers specific to insurance companies on its website. Policyholders should be aware of which hospitals in their city are on the excluded provider list. You can check the list of such hospitals by insurance company here.

How to Choose MD INDIA TPA for Your Health Insurance Policy

If your health insurance policy is serviced by a TPA, you can request your insurance company to select MD INDIA TPA either at the time of purchasing the policy or during its renewal.

As per IRDAI regulations, insurance companies are required to provide policyholders with the option to choose a TPA from the list of TPAs engaged by the insurer in that specific region. Therefore, policyholders can select a TPA of their choice, but only from the options offered by the insurance company. If MD INDIA TPA is not available in your region with a particular insurer, you must choose from the TPAs provided by the insurance company.

If you have any query regarding this post feel free to ask in comments.